Lodge your Tax Return effortlessly and spend time on your big idea

July 13, 2018 10:38 am | by John Adams

At the end of financial year whether you are in Australia, New Zealand or anywhere in the world, all companies have tax obligations. The requirement to produce your Profit & Loss and Balance Sheet at the end of the financial year is mandatory for all businesses and organisations.

A financial year (or fiscal year, or sometimes budget year) is the period used by governments and their tax agencies for accounting and budget purposes, which vary between countries. It is also used for financial reporting by business and other organizations. Laws in many tax jurisdictions/countries require company financial reports to be prepared and published on an annual basis, but generally do not require the reporting period to align with the calendar year. The End of Financial Year (EOFY) is the date that marks the end of the financial year.

The calendar year is used as the financial year by about two thirds of publicly traded companies in the United States and for a majority of large corporations in the UK and elsewhere, with notable exceptions being in Australia, New Zealand and Japan. In Australia the End of Financial year generally falls on June 30th, New Zealand ends their financial year on March 31st. Some organisations and companies follow the USA end their financial year which is often on the same day of the week each year, for example, the Friday closest to 31 December. Under such a system, some fiscal years will have 52 weeks and others 53 weeks.

Taxation laws generally require accounting records to be maintained and taxes calculated annually, which usually corresponds to the financial year used by the government. The calculation of tax on an annual basis is especially relevant for direct taxation, such as company income tax. Many annual government fees and levies—such as Council rates, licence fees, etc. are also calculated on a financial year basis, while others are charged on an anniversary basis.

Many educational institutions have a financial year which ends during the summer to align with the academic year (and, in some cases involving public universities, with the state government’s financial year), and because the university is normally less busy during the summer months. In the northern hemisphere this is July to the next June. In the southern hemisphere this is calendar year, January to December. Some media/communication-based organisations use a broadcast calendar as the basis for their fiscal year.

Whatever the size of your business and tax obligations, you must report and pay any amount due to the ATO, this includes Superannuation and GST, VAT or Sales Tax reporting. It is essential to lodge tax return accurately in order to achieve the maximum business offset and possibly even receive a tax refund.

By managing everything from Financial Reporting, Inventory Control, Assets, Job Projects, Payroll/HR to Bank Reconciliations, SapphireOne ERP CRM DMS can give you more time to do the things that matter, such as developing new strategies and thinking in your business or organisation.

SapphireOne helps you to prepare and lodge tax return

SapphireOne helps you calculate GST and seamlessly lodge your Business Activity Statement (BAS) Standard Business Reporting (SBR2), pay employees and track your PAYG and Superannuation.

SapphireOne ERP CRM DMS can generate comprehensive reports to help you prepare and lodge tax return. Effortless reporting of SapphireOne can help you to get the right data at the right time including Year to Date (YTD) financial reports, PAYG payment summaries, Profit & Loss and Balance Sheet reports. That’s why Alison Phillips from Moyle Bendale Timber said in her testimonial that “SapphireOne is a RocketShip because of its excellent reporting.”

For a sneak peek at the full capabilities ERP, CRM, Accounting Software, Human Resources, Payroll, Assets and Document Management, check out SapphireOne and request a live demo, it is everything you’ll ever need to make your company management a success. Know more about us.

Simplifying the concept of end of financial year

July 11, 2018 10:34 am | by John Adams

The Australian financial year typically starts from 1st July and ends on 30th June. The 30th June is also known as end of financial year when businesses start preparing their financial reports in order to submit their financial position to the Australian government. In New Zealand the end of financial year is on 31st March, in the United States of America the financial is typically the last Friday of December.

Documents needed for end of financial year

A range of documents are needed to assess the tax obligations of your business such as Income Statement, (also known as the Profit and Loss P&L) and Balance sheet.

The objective of financial statements is to provide information about the financial position, performance and changes in financial position of an enterprise that is useful to a wide range of users in making economic decisions. Financial statements should be understandable, relevant, reliable and comparable. Reported assets, liabilities, equity, income and expenses are directly related to an organization’s financial position.

Countries over time have developed their own accounting methods and principles, making international comparisons of companies difficult. To ensure comparability and uniformity between financial statements prepared by different companies, a set of guidelines and rules are used. Commonly referred to as Generally Accepted Accounting Principles (GAAP), these set of guidelines provide the basis in the preparation of financial statements.

SapphireOne ERP CRM DMS can support unlimited number of companies in unlimited tax jurisdictions in one data file. SapphireOne also support multiple foreign currencies and unlimited number of foreign bank accounts, supporting all your foreign exchange (FX) requirements.

Income statement / Profit and Loss (P & L)

The Income Statement or Profit and Loss (P & L) measures a company’s income and expenses during a specified period of time. A profit and loss statement provides information on the operation of the enterprise. These include sales and the various expenses incurred during the stated period.

The Income Statement is one of the most important financial statements a business or organisation issues annually, along with the balance sheet and the cash-flow statement.

SapphireOne ERP CRM DMS has the ability to run the current year versus last year reports, or if required up to ten years historical data on the one report.

SapphireOne also has the ability to copy last year’s actual general ledger balances into the current year’s budget.

Balance sheet

The company Balance Sheet represents company’s financial position, which is important at the end of financial year. The Balance Sheet outlines the total assets, liabilities and owner’s or stockholders’ equity at a specified point in time. Assets the business owns, such as vehicles, plant and equipment, property, intellectual property and cash in the bank are included on the Balance Sheet, depreciation of these assets is included on the Income Statement (P&L). Liabilities include your creditors, payroll obligations such as employee’s annual, carer and long-service accrued leave.

SapphireOne ERP CRM DMS financial reporting has the ability to export data to spreadsheet and also import data to the general ledger budget via the Sapphire API gateway.

For a sneak peek at the full capabilities ERP, CRM, Accounting Software, Human Resources, Payroll, Assets and Document Management, check out SapphireOne and request a live demo, it is everything you’ll ever need to make your company management a success. Know more about us.

Give your Business a fresh start in new financial year 2018-2019

June 26, 2018 10:05 am | by John Adams

A new financial year can be a perfect time for making changes in your business. You can use this time to improve the efficiency by implementing a new ERP/CRM/DMS such as SapphireOne.

The vast majority of organisations and businesses are running various applications. Examples include using spreadsheets for budgeting, separate databases for tracking contacts, and inventory managements systems that are not linked adequately. They are often running separate Payroll and human resource (HR) systems and not linked to their financial date. This makes it difficult to manage people in your organisation or business.

It is essential that in today’s demanding business environment that we obtain a single point of truth. This relates to the organisation and business data requirements. SapphireOne ERP,CRM,DMS application shines in this area.

SapphireOne ERP,CRM,DMS works with your accountant or financial advisor. The system will compile all your financial statements and end of financial year reports. Once this is completed, it is an extremely simple process to copy last year’s actuals. These are for your general ledger and placed into the budget for the coming financial year.

Improve your business performance this financial year with SapphireOne

When reviewing your business financial data, SapphireOne’s integrates general ledger budgeting. There is the ability to store multiple budgets, per general ledger. This allows you to copy those budgets to revised budgets if required. This puts you in a perfect position to review your business performance and make strategic decisions to help your business be more profitable and grow.

Improve your Profit and Sales performance

SapphireOne ERP has Dashboards, also called Business Intelligences (BI) or Key Performance Indicator (KPI) Dashboards. These present business statistics and performance indicators in a visually attractive and graphically intuitive interface. The dashboards utilises graphs, bar charts and other visually engaging design elements that provide a succinct overview of a business’s financial standings. This is where you can quickly and visually view the profitability, sales performance and cash flow. This will ensure your overall business performance improves.

SapphireOne can help you to draw insights from the current financial and cash flow position, review your client’s performance in the past year which will facilitate you to support your client in mapping out their business goals for the next 12 months.

For a sneak peek at the full capabilities ERP, CRM, Accounting Software, Human Resources, Payroll, Assets and Document Management, check out SapphireOne and request a live demo, it is everything you’ll ever need to make your company management a success. Know more about us.

Justice Bromwich in the Federal Court of Australia made orders restraining Sapphire Systems Pty Ltd from infringement of our Sapphire Trade Mark

June 19, 2018 5:09 pm | by John Adams

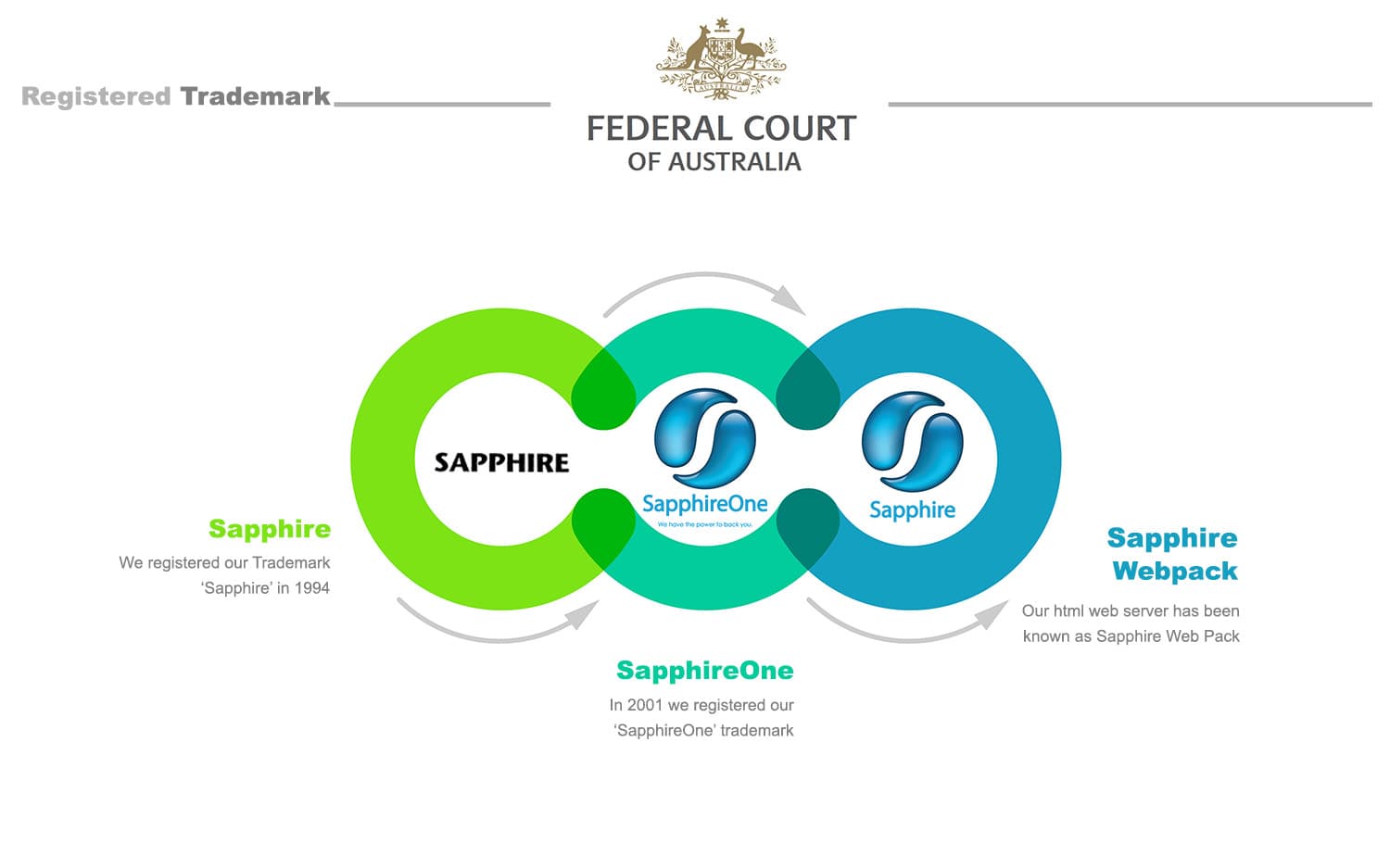

In May 2017, Justice Bromwich in the Federal Court of Australia made orders restraining Sapphire Systems Pty Ltd from infringement of our Sapphire Trade Mark (a copy of the orders can be viewed at this link).

An order was subsequently made that Sapphire Systems was required to pay us $20,000 and also pay our legal costs incurred in the proceedings.

Our company SapphireOne Pty Ltd was delighted to have its concerns of unauthorised infringement of its intellectual property rights vindicated in such a fulsome way.

We were represented by the following legal team:

Bart Adams of Adams & Co Lawyers

Barrister Andrew Fox

www.5wentworth.com/junior-counsel/andrew-fox

Barrister Anna Spies

SapphireOne is an Australian company distributing globally providing an all-inclusive software application for managing Enterprise Resource Planning (ERP), Contact Relationship Management (CRM) and Document Management System (DMS). These offerings consist of a standalone Single User application named Sapphire, our Client Server application named SapphireOne and our Sapphire Web Pack solution. With our clients established globally, SapphireOne has been providing business freedom since 1986.

We registered our Trademark ‘Sapphire’ in 1994, this was our first Trademark registration initially registering it in Australia.

In 2001 we registered our ‘SapphireOne’ trademark. The additional name was brought about by the merger of the Sapphire Financials, Sapphire Assets, Sapphire Point of Sale (POS) and Sapphire Payroll Human Resources (HR) into a single application, hence we added the ‘One’ to signify the unification of all four applications into one.

From this point onwards our Single User standalone application has been known as Sapphire, our client server application has been known as SapphireOne, our html web server has been known as Sapphire Web Pack.

For a sneak peek at the full capabilities ERP, CRM, Accounting Software, Human Resources, Payroll, Assets and Document Management, check out SapphireOne and request a live demo, it is everything you’ll ever need to make your company management a success. Know more about us

Dynamic view of what is happening in your business with SapphireOne ERP Business Intelligence (BI) Dashboards

June 18, 2018 10:20 am | by John Adams

Business intelligence solutions today include a dashboard environment unique to each user featuring reports, graphs, tables and alerts. SapphireOne ERP generates reports that contains the key business performance indicators (KPIs) which are easily accessed by all SapphireOne users specific to their job function.

The SapphireOne ERP BI Dashboard is easy to understand, a visually intuitive graphic screen that represents a snapshot of what is happening in the fundamental areas of your business.

In SapphireOne ERP, BI Dashboard users are given a dynamic view of KPIs relevant to their key area of responsibility.Utilising thedashboards allows you to examine key processes within an organisation and highlight ones that are competitive differentiators.

SapphireOne ERP BI Dashboard can lead to business processes improving

Business process management is a holistic approach used to evaluate, improve and align business processes to an organisations’ overall goals and strategy. It ensures that your business is on the right track which in turn helps you grow your business.

Using various approaches of business process management and with the help of SapphireOne ERP BI Dashboards, you can identify the current position and primary key performance indicators (KPIs) to measure success. Our BI Dashboards process and analyse your business data enabling managers to receive real-time statistics of the business.

SapphireOne is a fully integrated ERP, CRM, DMS and Business Accounting application

The Sapphire ERP application integrates all aspects of your business into one single application. It automates all processes including Inventory Management, Logistics, Distribution, Warehouse Management, Materials Resource Planning (MRP), Payroll/HR, Web Pack, Document Management System (DMS) and Contact Relationship Management (CRM).

Consolidation into a single unified database ensures greater efficiency and provides better visibility. SapphireOne has the majority of screens following the same basic layout, this enables users to quickly enter data using the same procedure throughout the software to enhance performance and ease of operation.

For a sneak peek at the full capabilities ERP, CRM, Accounting Software, Human Resources, Payroll, Assets and Document Management, check out SapphireOne and request a live demo, it is everything you’ll ever need to make your company management a success.

Free Single Touch Payroll with SapphireOne

May 21, 2018 10:26 am | by John Adams

SapphireOne Free Single Touch Payroll has been whitelisted and certified for STP (Single Touch Payroll) using the SBR2 (Standard Business Reporting) Portal with the Australian Taxation Office. All SapphireOne clients on current support plans will be given Single Touch Payroll and SBR2 connectivity with the SapphireOne application.

What has changed?

Single Touch Payroll (STP) aligns your reporting obligations to your payroll processes.

You will report to the Australian Taxation Office (ATO) each time you pay your employees. Your pay cycle does not need to change. You can continue to pay your employees weekly, fortnightly or monthly.

The information you send the Australian Taxation Office (ATO) will include your employees’ salaries and wages, allowances, deductions (for example, workplace giving) and other payments, pay as you go (PAYG) withholding and superannuation information.

Employers with 20 or more employees:

- You need to start reporting pay events to the Australian Taxation Office through Single Touch Payroll from 1 July 2018.

Employers with 19 or less employees:

- From 1 July 2019 STP will be mandatory, subject to legislation passing in the Australian Federal parliament.

- You can choose to report through STP before 1 July 2019.

How does Free Single Touch Payroll benefit users of SapphireOne?

Employers will no longer be required to submit an annual PAYG report to the Australian Taxation Office

Employees will be able to view their payment information in ATO online services, which they will access through their myGov account.

New employees will have the option of completing TFN declarations and Super Choice forms online.

Businesses will reduce administrative burdens and costs (other software providers are charging for this service on a pay event or per employee rate)

For a sneak peek at the full capabilities ERP, CRM, Accounting Software, Human Resources, Payroll, Assets , Document Management and Multi-Company Accounting feature check out SapphireOne and request a live demo, it is everything you’ll ever need to make your company management a success.