Effectively Process vendor invoices and bring accuracy & transparency in Reporting

May 5, 2020 8:45 am | by John Adams

In today’s business climate, organisations in every sector are under pressure to do more with less. Businesses worldwide operate based on the expenditure cycle and the revenue cycle. The full cycle Accounts Payable process falls under the broader expenditure and purchasing cycle. The process includes the complete range of essential accounting activities needed to complete a purchase when a Purchase Order is placed and the client receives the desired product or service. By improving Accounts Payable governance, setting up clear management processes and consistently tracking key metrics, businesses can streamline their processes and inject a working capital culture into their enterprise.

Accounts Payable process

Every business, no matter how large or small, has invoices to pay. These invoices are normally for goods and services provided by their vendors. Receiving, approving and paying these Vendor Invoices can be categorised into a process called Accounts Payable (AP). The Accounts Payable process or function is immensely important since it involves nearly all of a company’s payments outside of Payroll. To safeguard a company’s cash and other assets, the Accounts Payable process should have internal controls. A few reasons for internal controls are:

- To prevent paying a fraudulent invoice

- To prevent paying an inaccurate invoice

- To prevent paying a vendor invoices twice

- To be certain that all vendor invoices are accounted for.

Without the Accounts Payable process being up-to-date and well run, the company’s management and financial reporting will receive inaccurate data on the company’s performance and financial position. A poorly run Accounts Payable process can also mean missing a discount for paying Vendor Invoices on time. If vendor invoices are not paid upon their due date, supplier relationships will be strained. This may lead to those vendors demanding cash on delivery. If that were to occur, it could have extreme consequences for a company’s financial position.

A perfect Accounts Payable (AP) process can be broken down in to 5 steps:

- Invoice received – sent by the vendor via email or post

- Invoice recorded – details are manually entered into the ERP system

- Invoice approved – authorised by the person who ordered the goods and services

- Invoice paid – details are checked before the amount is paid by Accounts Payables

- Invoice finalised – payment allocated to the invoice so that it no longer shows up as a liability in your ERP system

Challenges in the Accounts Payable process:

The steps above are indicative only and are considered the basic steps that need to be taken before payments are made in order to avoid errors and fraud. Large companies can sometimes have more steps in between, with additional approvals and verification being required before an invoice is paid.

SapphireOne ERP Accounting Software is a large-scale software solution designed for businesses, both large and small. Accounts Payable function of SapphireOne allows you to manage, organise and track your payments to vendors. This includes the tracking of cash, EFT, credit cards and any other types of payments.

When researching each of the tasks in the manual Accounts Payable process and categorising their associated problems, it reveals four key challenges facing AP departments:

- Cost per invoice

- Accuracy and efficiency

- Transparency and reporting

- Risk of invoice fraud

The ability to group vendors for reporting and payment runs streamlines Accounts Payable

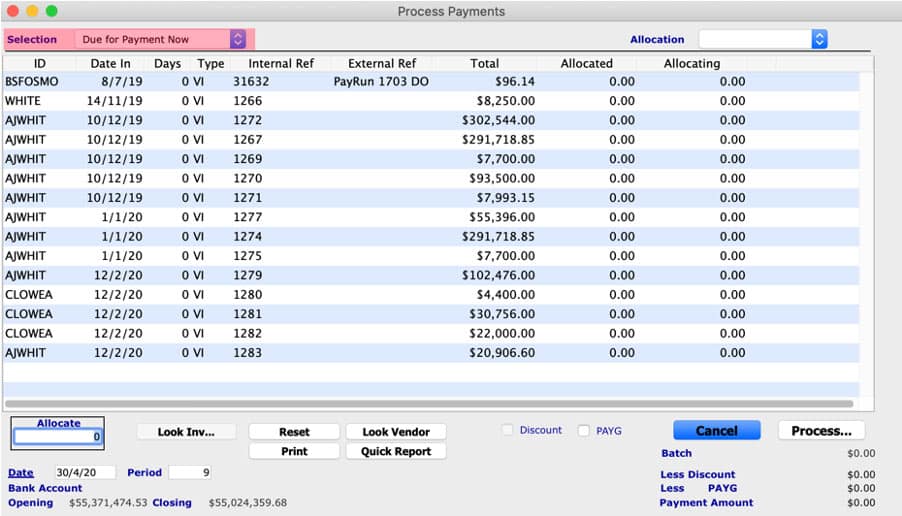

Accounts Payable allows for the creation of Payments for Vendors and generates the payments in different forms. Payments in SapphireOne can be created either by vendors or transactions. Grouping facilities are particularly useful when paying multiple invoices in a single process. This allows for reducing the costs of processing invoices. Additionally, high workloads increase the capacity for human error and create a risk of scrutiny, both internally and externally. Any inaccuracies and delays in processing and recording invoices can result in:

- A strain on human resources

- Misplaced, mishandled or overlooked invoices

- Inaccurate financial statements

- Issues during regulatory compliance audits

SapphireOne’s grouping functionality in payment run can immensely help to resolve these challenges.

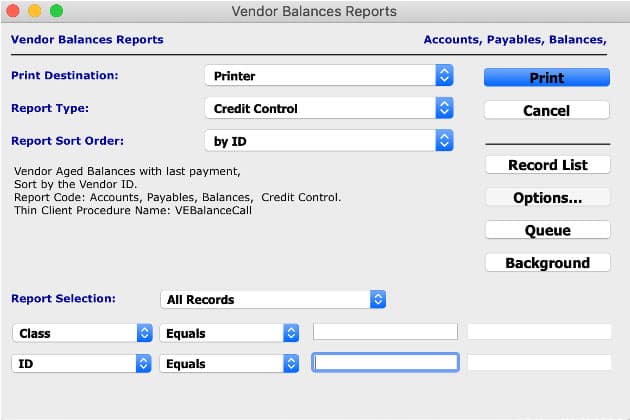

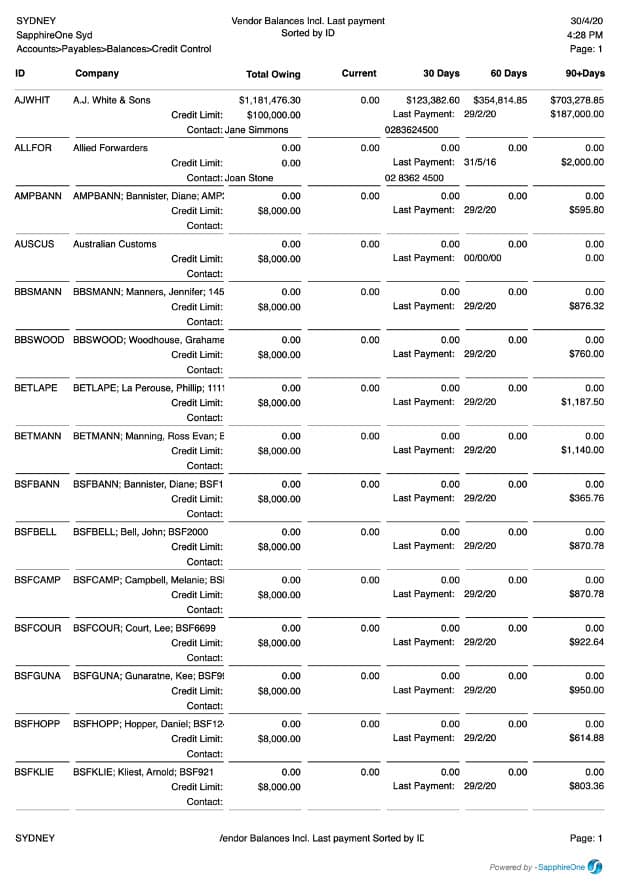

Reports allow the production of standard reports based on templates already designed in SapphireOne. There are four types of reports available: Details, Balances, Transactions, and Statements. The Balances Report allows the printing of Credit Information Reports on Vendors with outstanding amounts. SapphireOne allows the creation of unlimited vendor classes to classify vendors by product, industry, demographic region or as required. These groupings or classes can be used to print effective balance reports, creating the ability to eliminate another key challenge that is transparency and reporting.

A myriad of requests are regularly submitted to a finance team, containing everything from supplier queries, audit history reporting, invoice tracking, supplier spend, invoice status and monthly accruals and needs to be handled quickly and efficiently. A traditional non-automated process can create a lack of financial visibility and transparency for a finance department, which in turn can contribute to the increase in the transaction cost. Grouping or sorting by class or ID provides for clear visibility in finance reporting.

SapphireOne also has the unrestricted history functionality in Accounts Payable. Unlimited history allows the viewing of all historical data including transactions, distribution or activity history for a particular vendor. Historical data may be sorted or reviewed by calendar or financial periods giving the information required when and where needed.

SapphireOne automates the processes required to effectively manage sales and purchases. All functions from the processing of purchases through to the bank reconciliation are in real time. Transactions within Accounts Payable are updated across the system to the General Ledger Account immediately.

SapphireOne payables presents a detailed overview of the financial position of a business at any given time and provides accurate information on various features, such as automated cheque runs, electronic funds transfer (ABA EFT) and allocation of payments.