Entering JobKeeper Payments in SapphireOne

May 11, 2020 8:30 am | by John Adams

JobKeeper is a wage subsidy scheme recently introduced by the Federal Government to support businesses in navigating the severe economic impacts caused by COVID-19. It is aimed at maintaining jobs for Australian employees, as well as at helping companies to restart their business quickly once the crisis has passed. We know that there is a lot to take in when it comes to JobKeeper. For this reason, SapphireOne is providing you with continuous support to simplify the process of implementing this new program by adjusting your Payroll/HR.

New information and updates regarding JobKeeper are being released on a constant basis. Therefore, we advise all our clients to read the below instructions, even if they have already successfully set up JobKeeper payments according to our previous blog SapphireOne is now JobKeeper Ready. This will enable you to ensure that your settings are adjusted correctly to comply with the ATO’s reporting guidelines.

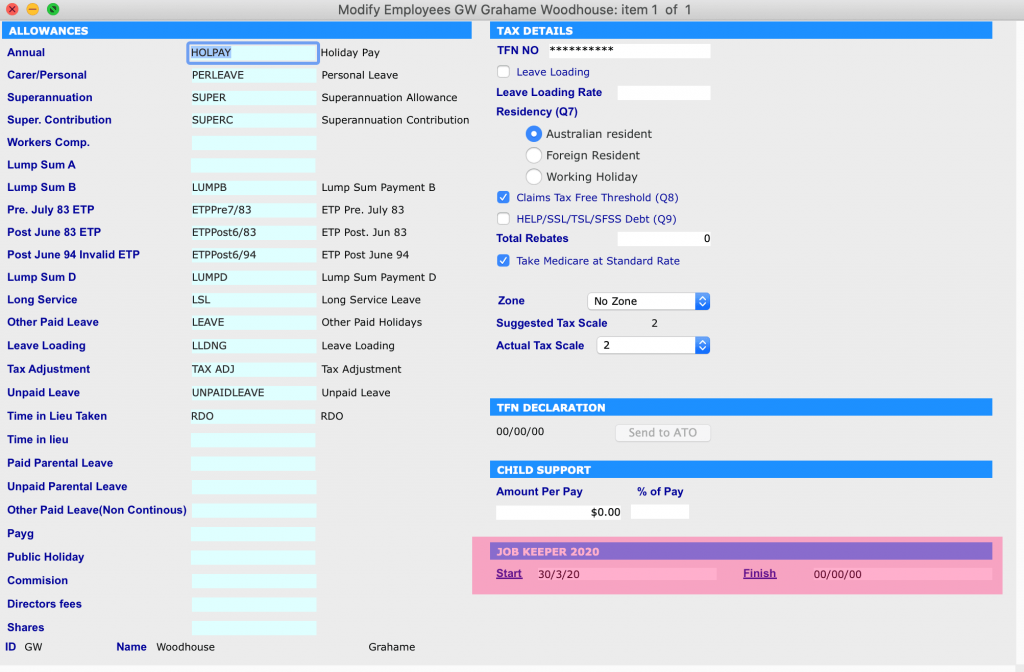

JobKeeper Start and Finish Date

Employers are obliged to indicate any wage payments made to their eligible employees under the JobKeeper scheme via STP. Further, they need to notify the ATO of the start date of the first JobKeeper fortnight they are claiming reimbursement for. The failure to do so will result in forfeiture of the claim.

Correspondingly, employers are also held to update the ATO about any ceasing of JobKeeper payments that were previously made to eligible employees. As a result, we recommend to our clients not to enter a Finish date. (Please be aware that this recommendation may change in the future in the case that the Government releases any new information. We will keep you updated of any changes via our blog.)

If either the employee or employer becomes ineligible while the JobKeeper scheme is still in place, a Finish date will have to be added before the end of the last pay run. Reasons for ineligibility include, for example:

- Receiving workers compensation payments

- Receiving Parental Leave Pay

- Receiving Dad and Partner Pay

- Cessation of employment

- Changes in the status of citizenship or visa

Update JobKeeper Payments in SapphireOne to comply with ATO guidelines

In case you have already set JobKeeper in SapphireOne, please follow the instructions below to adjust your settings to comply with the up-to-date reporting guidelines of the ATO.

1. Do not enter a JobKeeper 2020: Finish date.

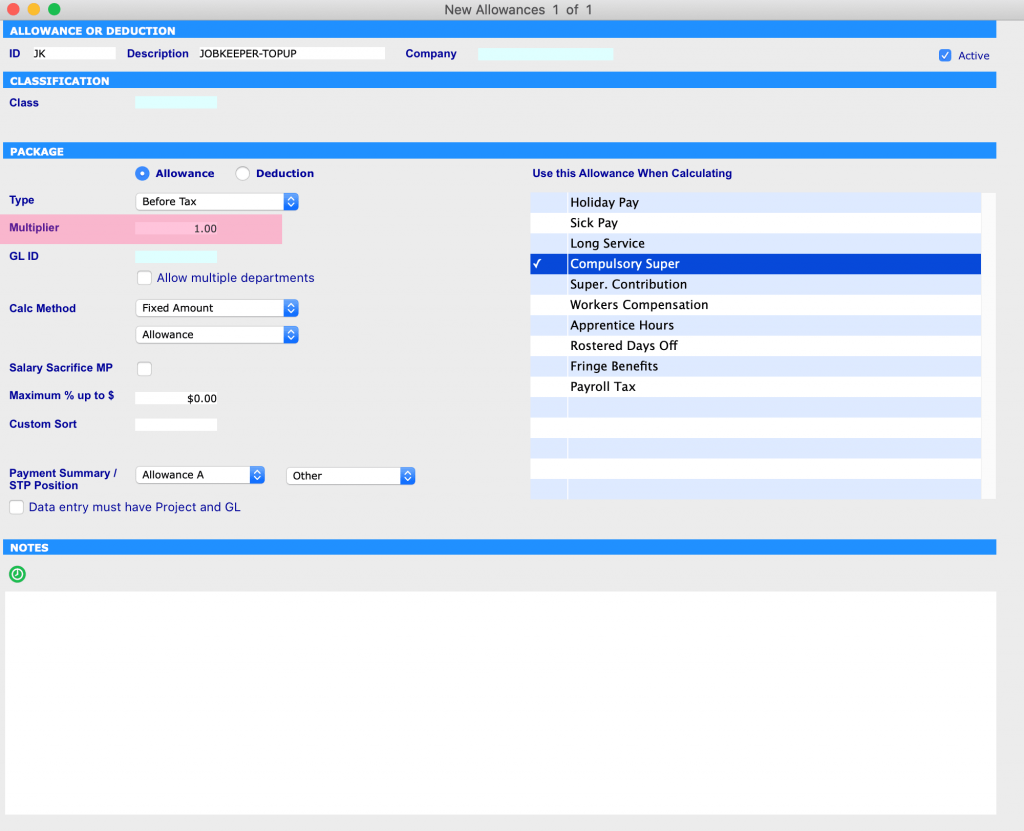

2. In the JobKeeper Allowance setting, set the Multiplier as ‘1.00’.

Additionally, you will need to adjust this value in Working Transactions for every employee who is eligible for JobKeeper payments.

Four Example Scenarios of Processing JobKeeper Payments

The below is an instruction on how to use SapphireOne’s JobKeeper Payment functionality in your pay run.

As the ATO has prescribed specific naming conventions for identifying various payments under the scheme, we advise our clients to use these in order to receive reimbursements without any unnecessary complications or delay. If you do not use the correct naming protocols, the STP will fail.

We have created 4 different scenarios to help guide you through the correct processing of JobKeeper payments.

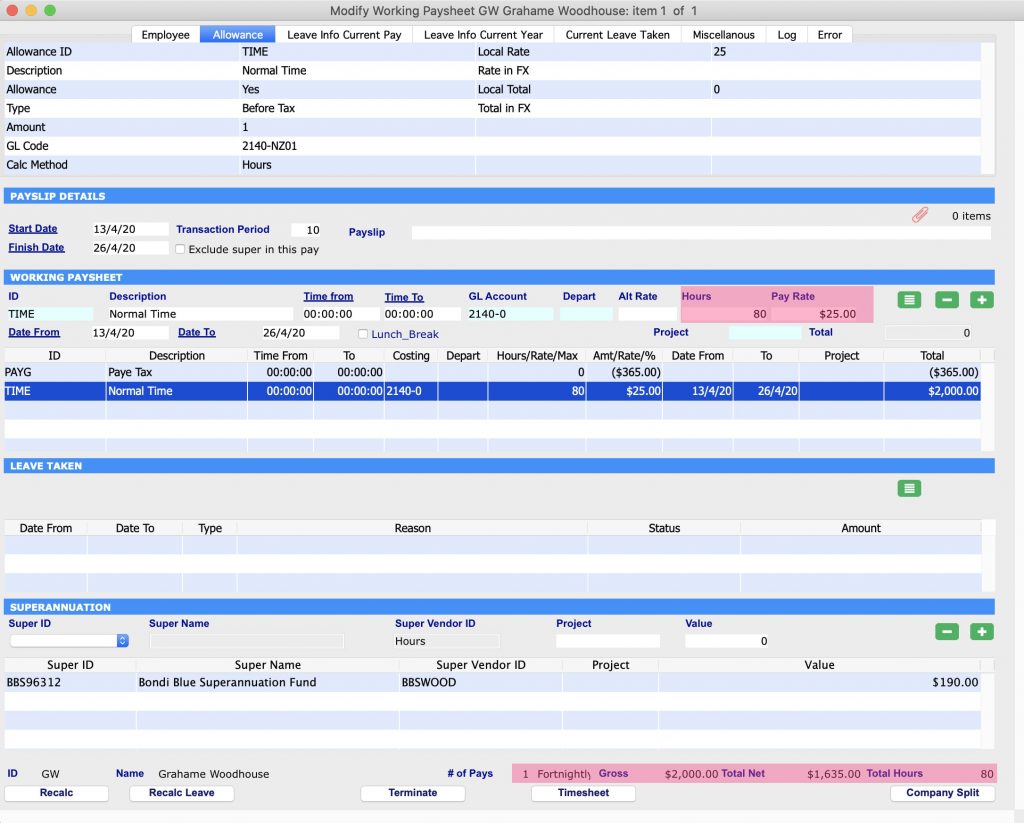

Scenario 1: Employee Alex receives $2000 per fortnight

Alex gets paid gross $2000 per fortnight. This value exceeds the JOBKEEPER-TOPUP amount. As a result, you do not need to add any entry of JobKeeper Allowance in Working Transactions. As long as you have set a JobKeeper Start date, SapphireOne’s system will automatically notify the ATO regarding JobKeeper payment via STP.

Scenario 2: Employee Bruce Gets receives $500 per fortnight

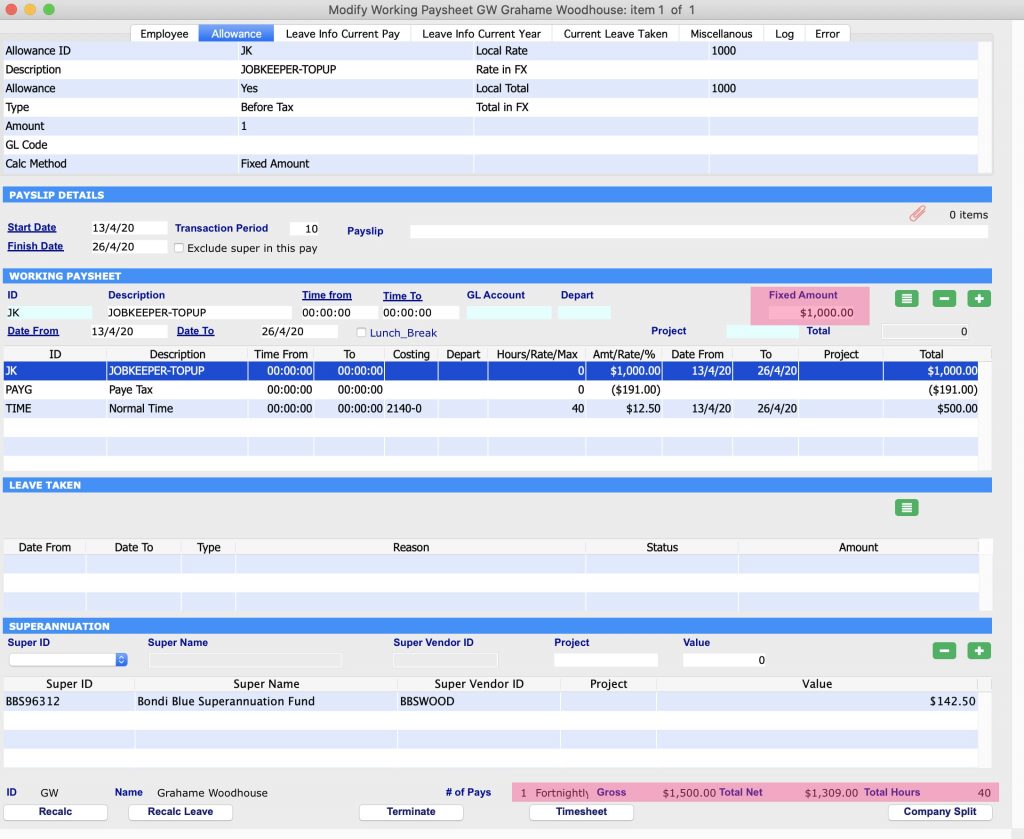

Bruce gets paid gross $500 per fortnight. This value is less than the JOBKEEPER-TOPUP amount. As a result, you will need to set JOBKEEPER-TOPUP Allowance to ‘$1000’. This will ensure that Bruce receives the correct amount of gross $1500 per fortnight under the JobKeeper scheme.

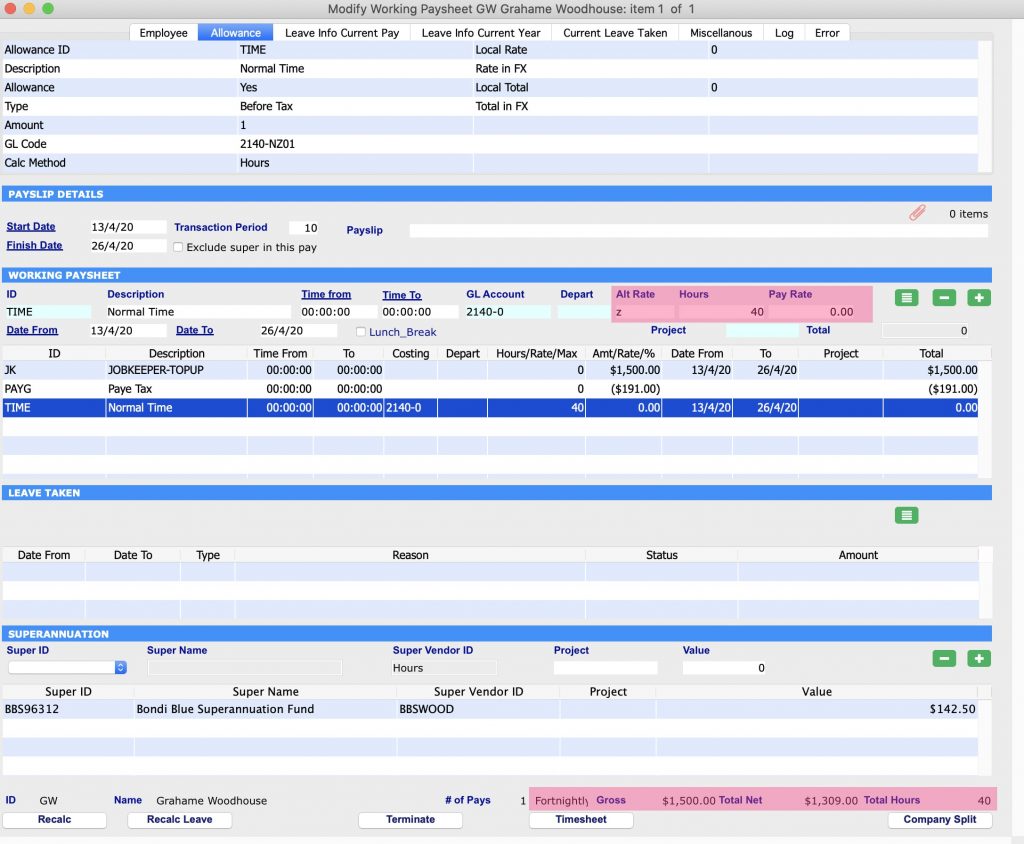

Scenario 3: Employee Chris is stood down and his normal working hours are 40 hours per fornight

Chris has been stood down, therefore his normal hours need to be entered at a Pay Rate of ‘0.00’. As a result, the system will accumulate leave for the 40 hours fortnightly he usually works. The value for JOBKEEPER-TOPUP Allowance needs to be set at $1500. This ensures Chris receives the JobKeeper payment.

If you encounter issues setting the Pay Rate at ‘0.00’, then enter ‘z’ as the Alt Rate before entering the Pay Rate.

Scenario 4: Employee David works in Payroll and previously made a JobKeeper payment not according to the guidelines

David already paid an employee a wage of gross $500 per fortnight. Instead of using ‘JobKeeper’ in accordance with the ATO’s prescribed naming conventions, he used ‘Bonus/Other’ in Working Transactions. To rectify this error and to be able to claim reimbursement, David has to create Working Transactions in the next pay run. There are two different methods available to him:

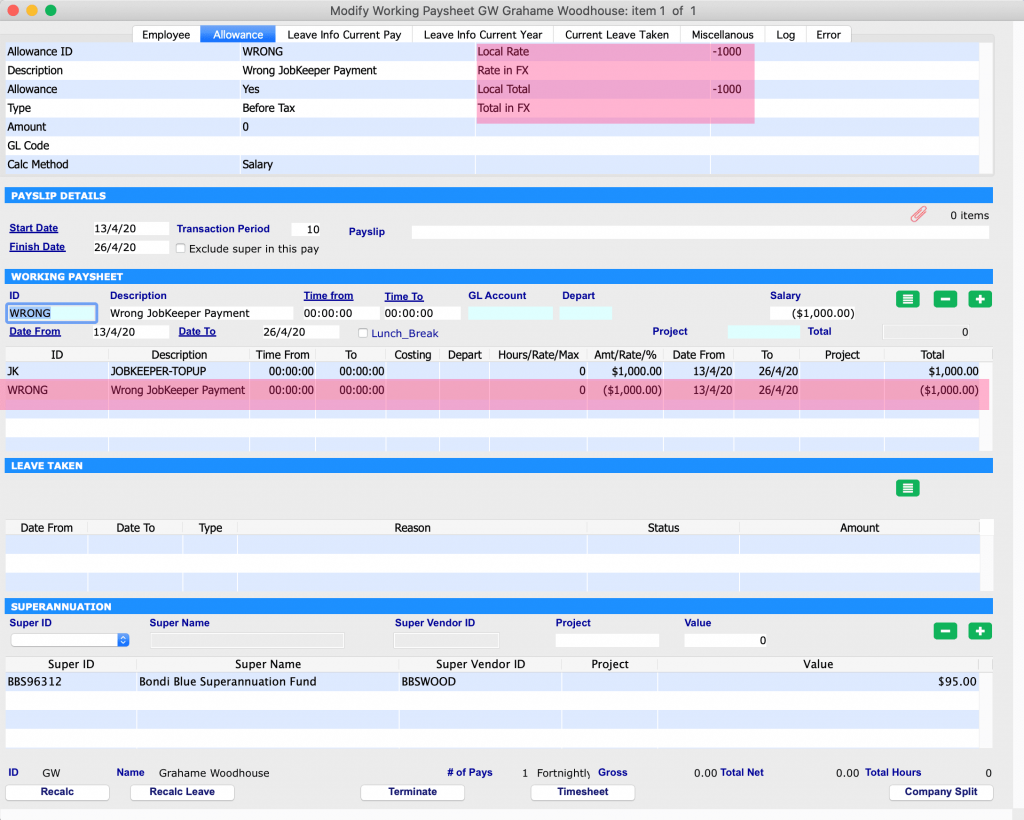

Scenario 4 – Method 1: David has to run two separate pay runs. The first one will adjust the prior wrong JobKeeper payment; the second one will pay the correct value.

Firstly, David needs to create a Working Transaction of two different types of Allowances for the employee. The JobKeeper payment needs to be entered as ‘+1000’ and the wrong Allowance as ‘-1000’.

Secondly, David has to follow the instructions of Scenario 2 above but only for the upcoming pay run.

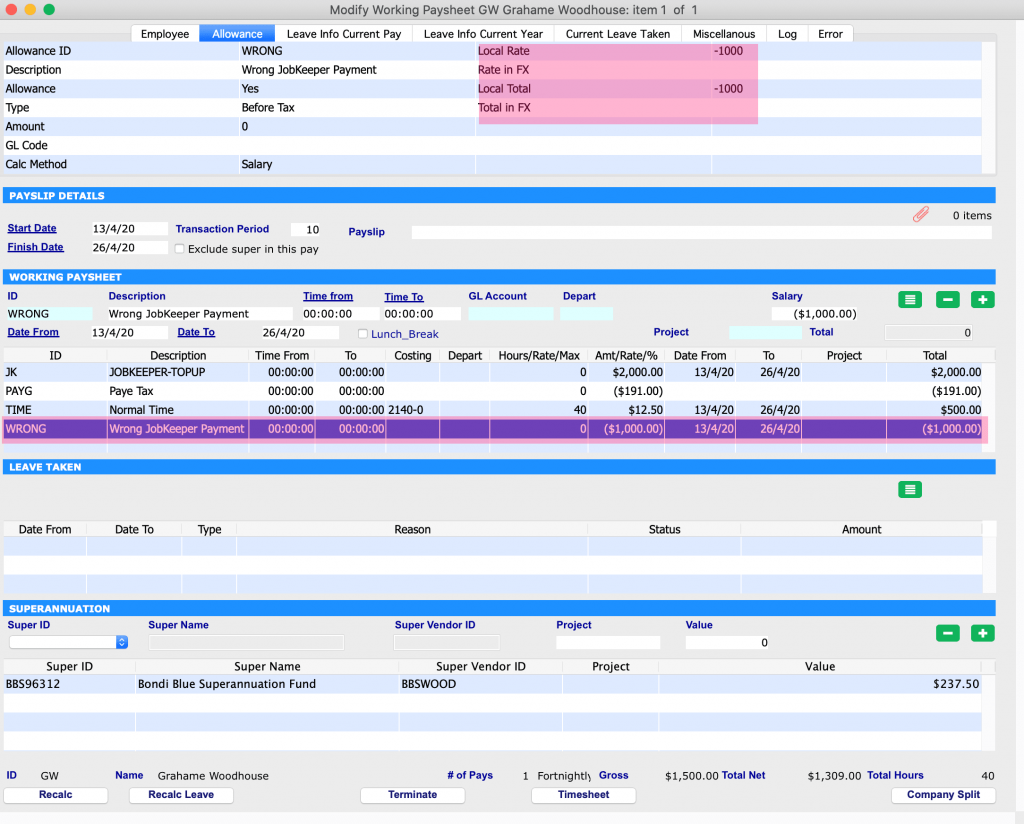

Scenario 4 – Method II: David has to adjust the Working Transaction for the employee by adding the JobKeeper allowance in addition to the wrong allowance.

Firstly, David needs to create a Working Transaction of three different types of Allowances: The Normal Salary has to be entered as ‘+$500’, the Wrong Allowance as ‘-$1000’ and the JobKeeper Payment as ‘+$2000’.

This ensures that the employee is receiving a JobKeeper Payment of $1500 and it also corrects the wrong payment that was made previously.

Secondly, David has to use this new Working Transaction for the upcoming pay run.

Please book a support call via our website, in case you have any questions or need any further assistance.