Job Management Software within SapphireOne ERP

August 18, 2020 10:57 am | by John Adams

The Job Management Software functionality of SapphireOne enables the managing of job projects, cost budgeting, resource planning and the creation of Gantt Charts all-in-one.

Data Entry in the Project Mode of our Job Management Software creates various transactions types which are indicated by a three-letter code.

The first letter stands for the origin of the transaction, in this case J for Job Projects.

The second letter further clarifies the origin, such as M = Monetary, C = Clients, G = General Ledger and V = Vendor.

The third letter represents the nature of the transaction i.e. R = Receipt, F = Refund, I = Invoice, C = Credit Memo, J = Journal, P = Payments.

For example,

- Job Client Invoice (JCI)

- Job Credit Memo (JCC)

- Job General Ledger Journal (JGJ)

Once a transaction is posted in our Job Management Software, it flows through to the Accounts Mode and finally appears in the Receivables Transactions Inquiry Window. For instance, a Job Client Invoice is now a standard Client Invoice.

The Job Project functionality creates its own set of General Ledger Accounts which are specific to the particular Project ID and GL account used. The GL account is created the first time an amount is allocated to the particular project.

- Job Costs

- Job Projects

- Job Inventory

- Job Resources

It involves the data entry, allocation and posting of Job Vendor Invoices, Job Project Purchases etc.

It allows for the tracking and allocation of resources to particular jobs, either by using an individual resource or project.

It is used to allocate inventory items to a specific Project for future use.

It enables the invoicing of goods and services and the direct allocation of such to a specific project.

For more information on how to manage job projects, undertake cost budgeting, resource planning and the creation of Gantt Charts with our Job Management software, please visit our website.

Track your expenses and Income with SapphireOne Job Projects

March 11, 2020 8:31 am | by John Adams

An expense tracker can simplify how you record your income and expenses, especially when one of the biggest challenges of running your own business is keeping on top of your accounts.

SapphireOne has a module named Job Projects which allows for an even greater level of control over the tracking of revenue costs, inventory and resources which are related to a specific task or job. The reason for the title Job Projects is because the activity or function may be either a Job or a Project, and in either case the tracking of costs and income is required for it. The job projects mode is designed to be adaptable to your individual business requirements. SapphireOne job projects will provide for a level of control over your costs, including materials and labour, to allow greater flexibility over the production process, so as to maximise project margins.

Easily manage the project income, billing and track costs

SapphireOne contains complete project management functionality that allows users to set up Project Tasks and manage the use of resources and inventory. The Job Project module of SapphireOne is used to perform all tasks involved with managing the project income billing and to track costs.

In SapphireOne Job projects can be set up as a standalone item or activity within the SapphireOne system and is then referred to as a Job Project. This may also be linked to a Parent Project. Once it has been linked to a Parent it will be referred to as a Child Job Project. There are a number of tools available for the management of Job Projects or Child Job Projects in SapphireOne.

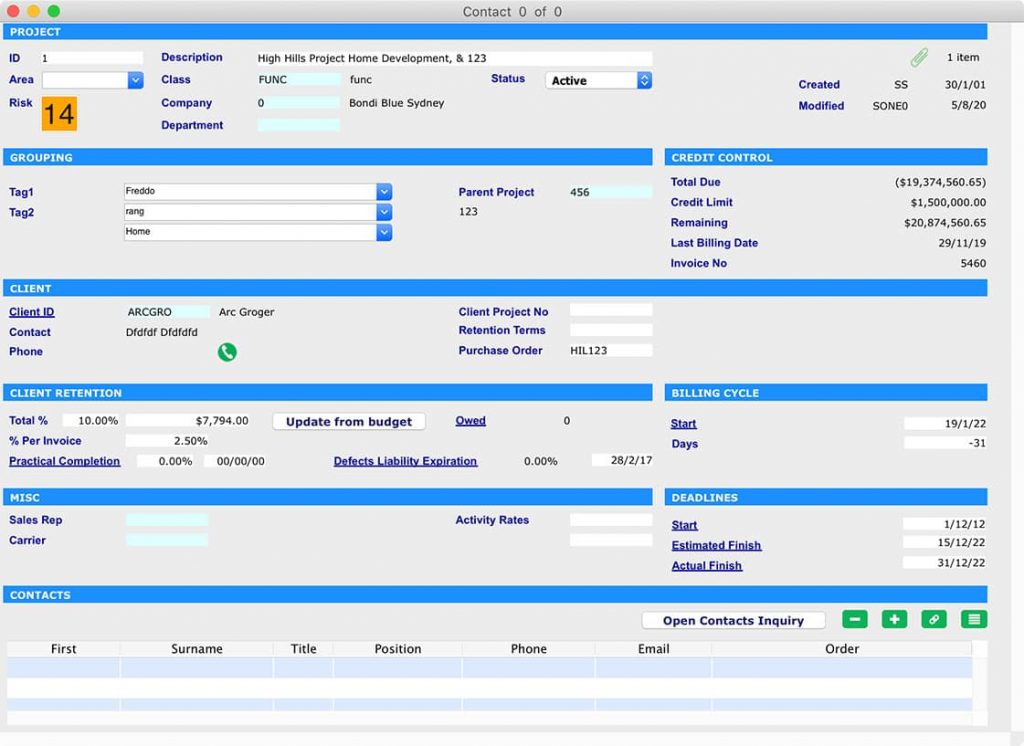

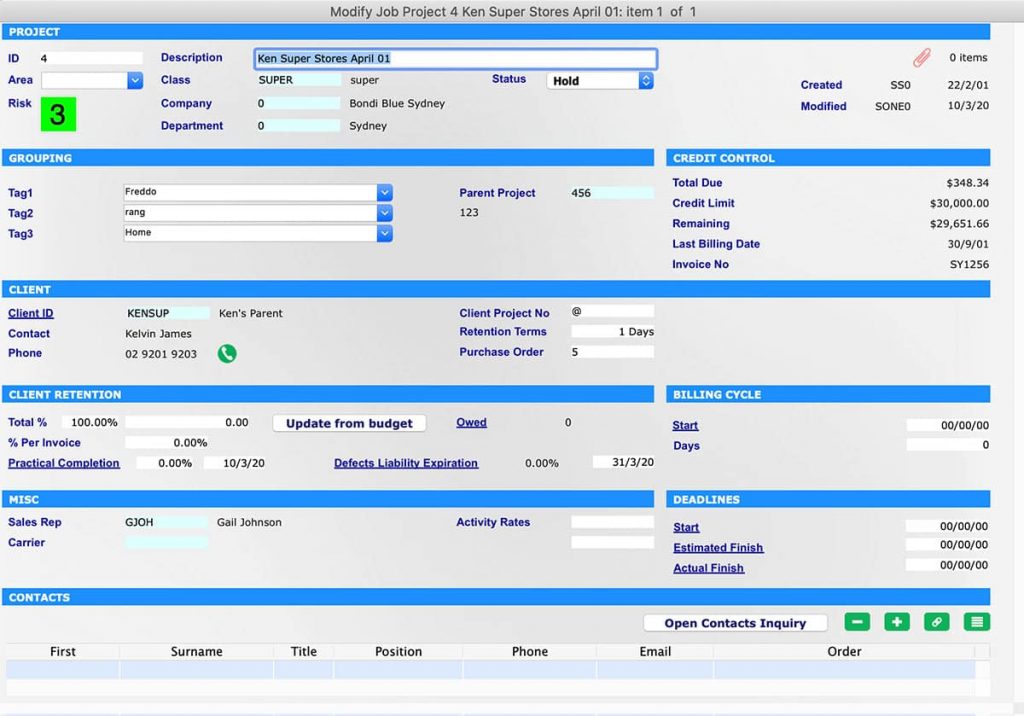

Project Area :

This area displays the details for the Project including ID, Description, Class, Department, Status and Risk level.

Grouping :

Grouping area display three tags which can be used for grouping and sorting purposes for better management. In addition of grouping, this area also contains a data entry field which will allows the user to enter a Parent Project. If there is no entry in Parent Project data field then the system will consider that this particular job/project is a standalone Job Project. However, if there is a parent project and then this Project will be considered as a Child Job Project.

Client Area:

Retention is an important function in Client area. Retention is security held by a procuring contractor to guarantee the performance of a supplying contractor and in particular to safeguard against defects in the event that the supplying contractor fails to satisfactorily rectify them. If the project has a as a percentage then it can be entered here.

Credit Control area:

If Client information is entered into the Client area, the system will access the Client’s record and display their credit details in Client Control area. This displays the Clients Total Due, Credit Limit, Remaining credit, last billing date and Invoice number in real time derived from client’s master record file.

Using the Job Project functionality of SapphireOne, Business intelligence can be accessed on profit potential at all times during the stages of production.

For a sneak peek at the full capabilities of an ERP, CRM, Accounting Software and API check out Sapphireone and request for a live demo, its everything you’d ever need to make management a breeze.

SapphireOne Community- a new platform to learn, share and connect

June 21, 2019 2:30 pm | by John Adams

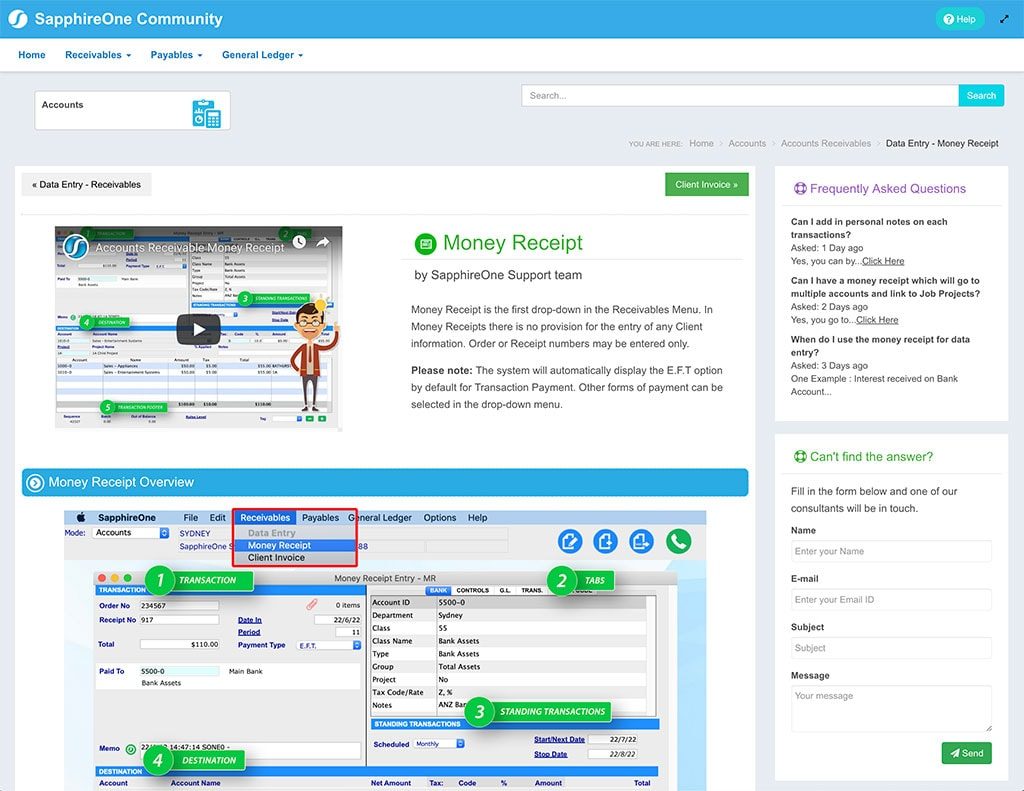

IT’S ARRIVED! SapphireOne would like to introduce a new resource for you called SapphireOne Community. This is a central place where our clients and users can access the latest guides, interactive manuals and step-by-step videos of our SapphireOne application.

It’s a great place to share, connect and ask questions on your ERP Accounting needs.

What to expect in SapphireOne Community

New features, release notes and latest versions will be listed on this Community platform to keep you ahead of changes.

To launch, we have been working on the Accounts Mode. Take a look at the easy to follow, intuitive overviews with tips and shortcuts that are bound to ensure working with SapphireOne is faster and more productive.

What’s to come- the rest of SapphireOne guides and videos on our 8 modes. These include Inventory, Job Projects, Payroll/HR, Assets Management, Management, Utilities and Workbook. Web Pack, Market Pack, Web POS and Release Notes will also be featured in detail giving you, the user a simplified way of learning.

Can’t find the information you need? Take a look at our Frequently Asked Questions (FAQ). Prefer to speak to one of the team? Fill in our form and we’ll be in touch.

The best part of Community- it’s online, allowing you access 24/7 on any device!

Discover now SapphireOne Community

In the meantime, rest assured our manuals are still available on the FTP server until the content is transferred into our Community site. The manuals are continuously updated with new and exciting features and are a tremendous guide for training and reference purposes.

To access the manuals, go to FileZilla, connect, then click on the Public Folder. In the SapphireOne Manuals folder you will find a list of the current versions. Highlight and drag the manual you would like to transfer to your desktop.

Click for more information regarding improvements and features within the latest release of SapphireOne ERP, CRM, DMS and Business Accounting Software Application. Alternatively, contact our office on (02) 8362 4500 or request a demo.

Lodge your Tax Return effortlessly and spend time on your big idea

July 13, 2018 10:38 am | by John Adams

At the end of financial year whether you are in Australia, New Zealand or anywhere in the world, all companies have tax obligations. The requirement to produce your Profit & Loss and Balance Sheet at the end of the financial year is mandatory for all businesses and organisations.

A financial year (or fiscal year, or sometimes budget year) is the period used by governments and their tax agencies for accounting and budget purposes, which vary between countries. It is also used for financial reporting by business and other organizations. Laws in many tax jurisdictions/countries require company financial reports to be prepared and published on an annual basis, but generally do not require the reporting period to align with the calendar year. The End of Financial Year (EOFY) is the date that marks the end of the financial year.

The calendar year is used as the financial year by about two thirds of publicly traded companies in the United States and for a majority of large corporations in the UK and elsewhere, with notable exceptions being in Australia, New Zealand and Japan. In Australia the End of Financial year generally falls on June 30th, New Zealand ends their financial year on March 31st. Some organisations and companies follow the USA end their financial year which is often on the same day of the week each year, for example, the Friday closest to 31 December. Under such a system, some fiscal years will have 52 weeks and others 53 weeks.

Taxation laws generally require accounting records to be maintained and taxes calculated annually, which usually corresponds to the financial year used by the government. The calculation of tax on an annual basis is especially relevant for direct taxation, such as company income tax. Many annual government fees and levies—such as Council rates, licence fees, etc. are also calculated on a financial year basis, while others are charged on an anniversary basis.

Many educational institutions have a financial year which ends during the summer to align with the academic year (and, in some cases involving public universities, with the state government’s financial year), and because the university is normally less busy during the summer months. In the northern hemisphere this is July to the next June. In the southern hemisphere this is calendar year, January to December. Some media/communication-based organisations use a broadcast calendar as the basis for their fiscal year.

Whatever the size of your business and tax obligations, you must report and pay any amount due to the ATO, this includes Superannuation and GST, VAT or Sales Tax reporting. It is essential to lodge tax return accurately in order to achieve the maximum business offset and possibly even receive a tax refund.

By managing everything from Financial Reporting, Inventory Control, Assets, Job Projects, Payroll/HR to Bank Reconciliations, SapphireOne ERP CRM DMS can give you more time to do the things that matter, such as developing new strategies and thinking in your business or organisation.

SapphireOne helps you to prepare and lodge tax return

SapphireOne helps you calculate GST and seamlessly lodge your Business Activity Statement (BAS) Standard Business Reporting (SBR2), pay employees and track your PAYG and Superannuation.

SapphireOne ERP CRM DMS can generate comprehensive reports to help you prepare and lodge tax return. Effortless reporting of SapphireOne can help you to get the right data at the right time including Year to Date (YTD) financial reports, PAYG payment summaries, Profit & Loss and Balance Sheet reports.

For a sneak peek at the full capabilities ERP, CRM, Accounting Software, Human Resources, Payroll, Assets and Document Management, check out SapphireOne and request a live demo, it is everything you’ll ever need to make your company management a success. Know more about us.

SapphireOne Business Accounting Software Structure

February 16, 2017 3:27 pm | by John Adams

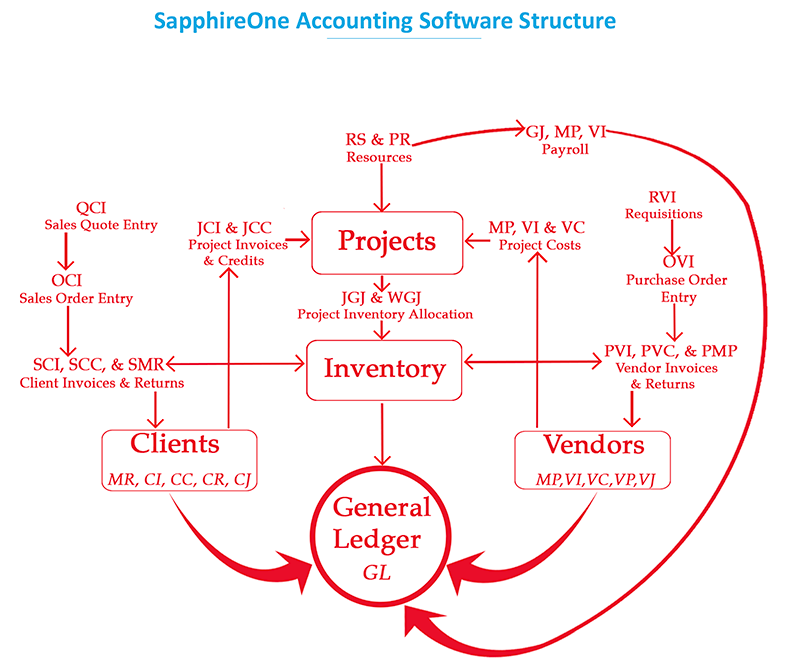

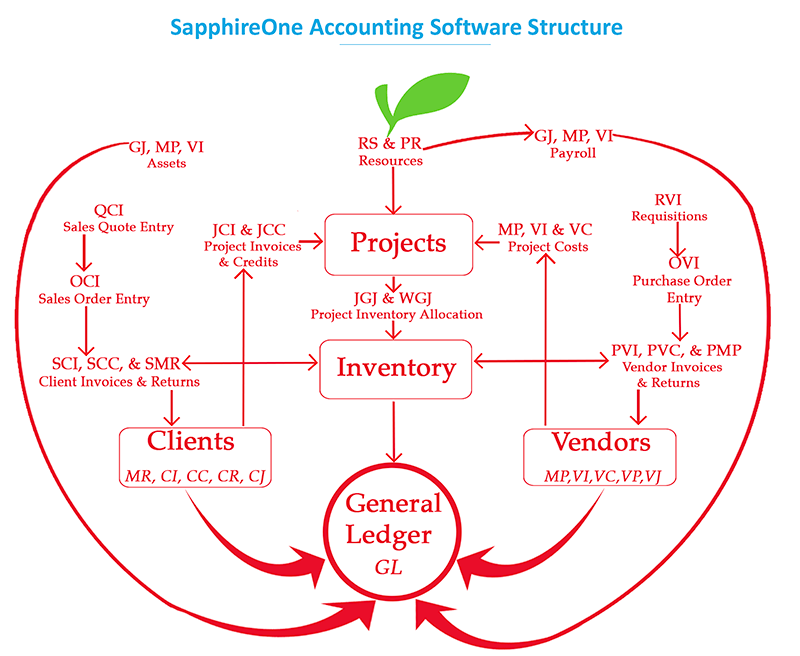

Organisation Structure of Sapphire Single user and SapphireOne Client Server, ERP Accounting Software is based on traditional double-entry accounting. The heart of a double-entry accounting system is the General Ledger, which is composed of a series of accounts called the Chart of Accounts.

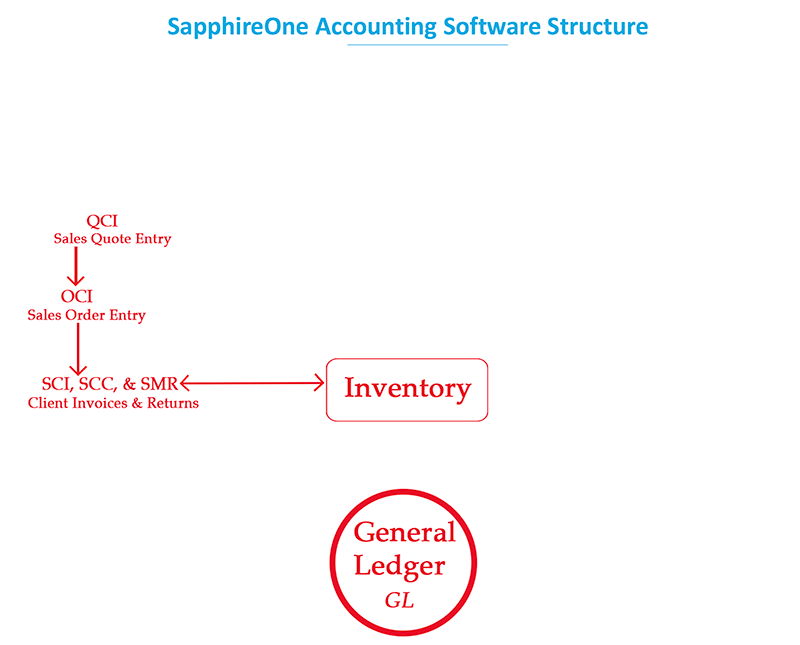

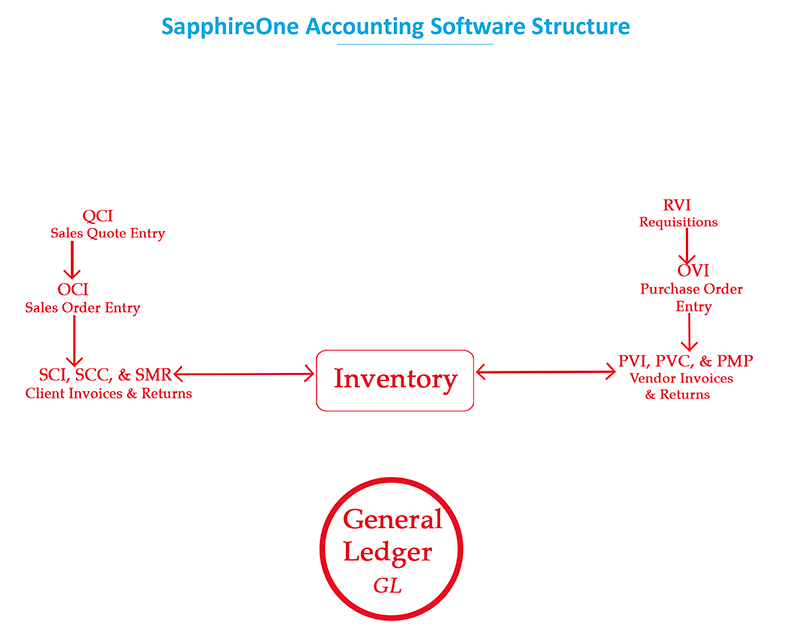

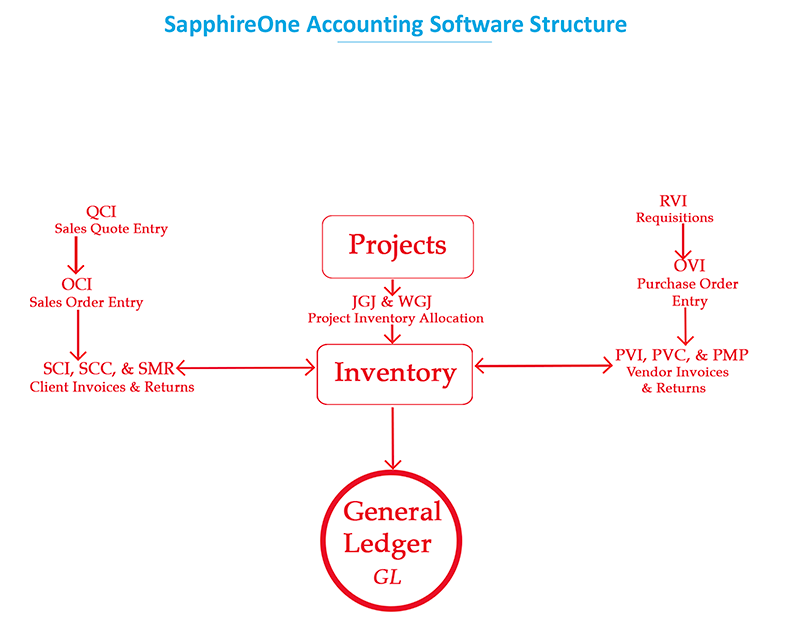

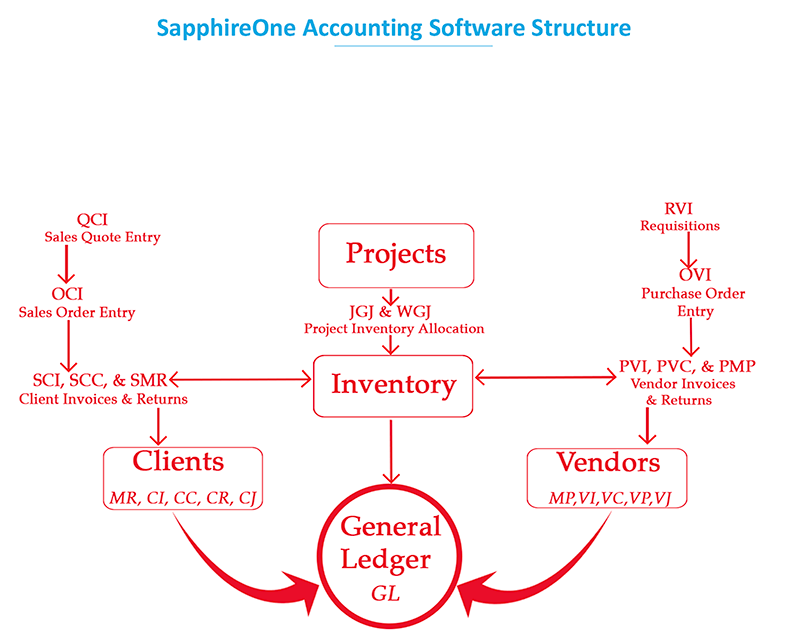

Accounting Software Structure :

Inventory is the heart of the Sapphire and SapphireOne system.

Sapphire and SapphireOne provides a comprehensive suite of inventory management functions. Almost all transactions from both Sales and Purchases within Sapphire and SapphireOne are based on an inventory item of some type.

On the sales side, we have a Quotes – type code QCI, Orders – type code OCI, Invoices – type code SCI, Client Credits – type code SCC

And on the purchasing side, we have Requisitions –type code RVI, Orders – type code OVI, Invoices – type code PVI, Vendor Credits – type code PVC

When projects are used, additional transactions will be created from projects mode; there are – Project Journals type code JGJ, Work Journals – type code WGJ

Accounts Mode-

Once the transactions have been raised in Inventory Mode the appropriate transactions may be linked transactions may be entered in accounts mode.

Clients

Sapphire and SapphireOne provides all standard accounting functions for the entry of transactions relating to your clients. These include:

Money receipts – type code MR, Client invoices – type code CI, client credits – type code CC, client receipts – type code CR, client journals – type code CJ

Vendors

Sapphire and SapphireOne provides all standard accounting procedures for the entry of transactions for your suppliers. These include:

Money payments – type code MP, vendor invoices – type code VI, vendor credits – type code VC, vendor payments – type code VP, vendor journals- type code VJ.

Posting a transaction will write the balances to your general ledger account and they may no longer be modified as is normal business practice once the transactions is posted.

Job Projects-

Job Projects are used when consolidation and the tracking of income and expedition is required.

Transactions that are created by Job projects from sales are Project Invoices – type code JCI and Project Credit Memos – type code JCC.

They are also created from the purchase side and these range from vendor invoices – type code VI and vendor credits – type code VC.

Resources may also be used in a Job project. These can be resource based. These transactions are given a type code RS. A job projects based transactions which is given a type code PR.

![]()

Payroll-

Sapphire and SapphireOne Payroll / HR is designed to complement Sapphire and SapphireOne Financials. Sapphire and SapphireOne Payroll operates with all the same standards and methods as Sapphire and SapphireOne Financials, including all reporting layouts.

Resource and project time sheets may also be directly imported into Sapphire and SapphireOne’s payroll / HR system.

Payroll / HR transfers data to financials using a general ledger journal – type code GJ, or Vendor Invoice type code VI.

Assets –

Sapphire and SapphireOne provide control of depreciation as well as the management of the purchase and sales of your company’s assets. Asset depreciation is calculated on a company basis and an Australian Taxation Office – ATO standard rate which is the rate that is transferred to your general ledger. The system uses a general ledger journal type code GJ, and vendor invoice – type code VI, when transferring the data to the general ledger.

~ Organisation Structure of SapphireOne Business Accounting Software Video ~