1 day left to replace your AUSKey with your myGov…Better Security and more flexible

March 26, 2020 1:07 pm | by John Adams

AUSkey will be replaced by myGovID and Relationship Authorisation Manager (RAM) at 11.59pm AEDT on Friday 27 March, 2020. Together, these services give you a secure, simple and flexible way to access government online services.

myGov ID is an easy and secure way to prove who you are online. Relationship Authorisation Manager (RAM), lets you manage who can use online services on behalf of your business. These two services makes accessing government online services, easier and more secure.

Important Notice for SapphireOne Users – Replace your AUSKey

If you are using the SapphireOne ERP System then you will be be using Single Touch Payroll (STP) functions or Business Activity Statement (BAS) through Standard Business Reporting (SBR). It is very crucial that you replace your AUSkey to myGovID today. If you do not replace it before 11.59pm AEDT on Friday 27 March, 2020 then you will no longer be able to use these services.

Steps for replacing AUSKey to myGovID

Step 1 :

If you already have myGovID then you are already one step ahead. If you don’t have myGovID then do the following:

- Download myGovID app from App store or Google Play and create myGovID

- Verify your email address as directed

- Achieve a Standard identity strength by verifying 2 documents ( eg: passport, driving licence )

- Scan your ID documents or enter details manually

- Your myGovID should be ready to use

When you enter your credentials to login in myGovID using your Windows PC or Mac via your browser like Safari, Firefox or Google chrome, the system will send a 4 digit code in your myGovID mobile phone application. You will need to enter that 4 digit code or Accept it, in order to securely access myGovID.

Step 2 :

To get started with Relationship Authorisation Manager (RAM), first the principal authority needs to set up their myGovID and link to their Australian business number (ABN) in Relationship Authorisation Manager (RAM). Once linked, they can set up authorisations for employees and others to act on behalf of the business who will accept the authorisation in Relationship Authorisation Manager (RAM).

To get started visit – https://authorisationmanager.gov.au/

From here you will be able to link your business, view and manage your business authorisations, accept an authorisation request, manage machine credentials.

Step 3 :

Machine credentials allow DSPs, businesses and registered tax and BAS agents to interact with ATO online services through their SBR-enabled software. Machine credentials are installed from Relationship Authorisation Manager (RAM) ( step 2) and used in your SBR enabled software. This performs the same function as an Administrator or Standard AUSkey in your software.

Before you create a machine credential

Before creating a machine credential, you need to download and install the browser extension software compatible with your device’s operating system:

Windows – Chrome and Firefox

MAC OS – Chrome and Firefox

Below is the detailed guideline for installing Machine credential from the ATO.

Installing a machine credential guide

This guide provides step-by-step instructions on how to create a new machine credential for an entity in Relationship Authorisation Manager (RAM).

Step 1 – Using Chrome or Firefox, go to authorisationmanager.gov.au and select the myGovID login button.

Step 2 – Log in using your myGovID by entering the email address that you used to create your myGovID.

A code will appear. Open myGovID on your smart device, log in and enter the 4 digit code into the pop-up within the app. Tap Accept.

Step 3 – Click View or manage authorisations, machine credentials and cloud software notifications. You will be directed to a view of all the entities you can act on behalf.

Step 4 – Select the entity you would like to create a machine credential for.

Step 5 – The entity homepage will be displayed with a list of all the authorisations for the entity. Click the Manage Credentials tab in the toolbar.

Step 6 – The Manage credentials page is displayed. If you’ve already installed the required browser extension, go to the next step. If you have not yet installed the required browser extension, a message advising that browser extension software is required will appear.

Step 7 – Select Create machine credential.

Step 8 – Enter the following information:

- Keystore path – This will be pre-filled but can be changed if required. This is where the machine credential will be created and stored.

- Keystore password – Choose a password. It should include at least 10 characters with no space, an upper case letter, a lower case letter, a number and a punctuation character. You’ll provide this password within your software either when setting up or authenticating. You are not required to use your myGovID password for the ‘Keystore password’.

- Verify your keystore password.

- Credential name – Enter a name for the machine credential. You should create a name which will help you to easily identify the machine credential.

- Identify the Machine Credential Custodian – This will be pre-filled with your name and cannot be changed.

Tick the box to confirm you understand and accept the machine credential details. Click Download.

Step 9 – Click finish and your credentials have been installed.

Step 10 – From the Manage credentials page you can create, view, revoke and claim unassigned machine credentials for the entity.

For more details Visit – https://softwaredevelopers.ato.gov.au/usingmygovidramandmachinecredentials

How to Upload Machine Credential into SapphireOne

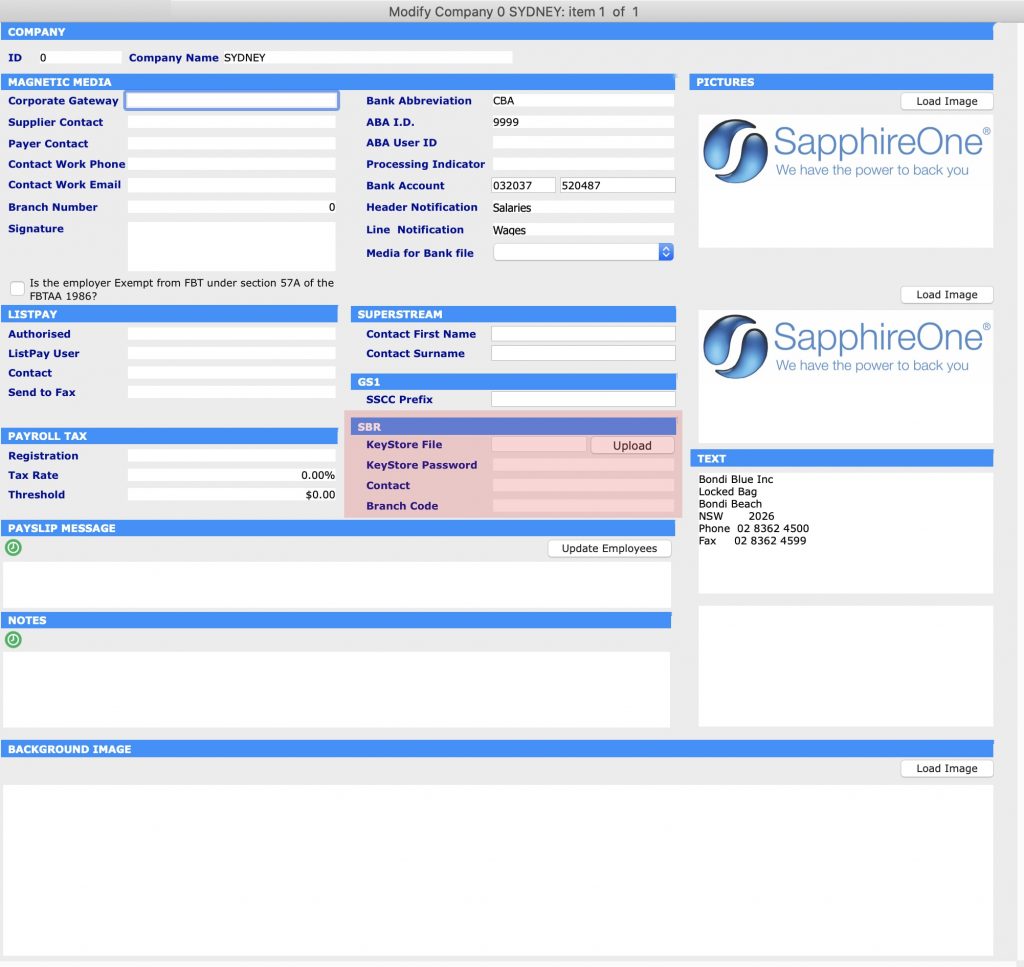

In order to upload the Machine credential into SapphireOne Go to Utilities > Controls > Company

Then click & modify the company where you want to upload Machine Credential. After that click More Details from the drop down menu.

Here in the middle of the screen you will see SBR section with an option to upload KeyStore file. Upload the Machine Credential file you have downloaded from authorisationmanager.gov.au and you will be ready to go.

ATO + SapphireOne = Relationship Authorisation Manager (RAM) to manage your company authorisations.

January 15, 2020 3:30 pm | by John Adams

Your AUSkey will retire in March 2020 and will be replaced with myGovID.

At the end of March 2020 your AUSkey will no longer be valid and will be replaced with your myGovID. Your myGovID can be managed using the ATO’s Relationship Authorisation Manager (RAM) – This will allow you to link your myGovID to your ABN and manage who can act on behalf of your business online.

You can already use myGovID and RAM for some participating government online services. This will extend to more government online services that use AUSkey or Manage ABN Connections.

Before you can submit a Single Touch Payroll event (STP) or submit a Business Activity Statement (BAS) through Standard Business Reporting (SBR), your AUSkey will need to be replaced by new machine credentials which are a component of the Machine to Machine (M2M) authentication solution.

Please click on the link below which explains how to create the machine credentials in the ATO Relationship Authorisation Manager which includes the steps you need to complete and details on installing the browser extension. There are several links to videos which will guide you through the process.

https://info.authorisationmanager.gov.au/business-software-user-or-provider

Machine credentials

The machine credential is installed on your computer and facilitates you to interact with the ATO online services through SapphireOne.

The

Machine credentials are created in the Relationship Authorisation Manager (RAM)

and replaces the AUSkey.

You will need to download and install the application plugin (Machine

credential download/browser extension) compatible with your computer’s

operating system:

Please note: Apple Safari, Windows Explorer, Microsoft Edge will not work with this plugin.

SapphireOne requirements are 17.2.1 or greater.

Please visit the Australian Taxation Office website for more details: https://info.authorisationmanager.gov.au

Documents for Tax Return you need to file

May 31, 2019 3:40 pm | by John Adams

Tax can be stressful and with the end of year tax return approaching fast, it’s best to start planning to avoid the headache. Your tax return reveals insights on how your business is performing. Decisions can be made on investments opportunities, where you can cut costs and opportunities arising to maximise profits. Super, GST and ATO reporting are all part of your tax obligations, so what documents for tax return do you need to make sure are lodged properly?

6 requirements of your business tax return

Not every business will have same requirements. Here are a few fundamentals that need to be calculated, and documents for tax return that are necessary to lodge a successful one.

BAS and PAYG reporting

Have you been lodging your Business Activity Statement BAS, via SBR2 Pay-As-You-Go PAYG and superannuation throughout the year? Single Touch Payroll STP also became mandatory on the 1st July 2018 for companies with over 20 employees as the new way of paying wages. Your BAS reporting should be monthly or quarterly and its important they are accurate and efficient.

Expense tracking

When it comes to expense tracking, make sure your data is up-to-date and categorised. This will make it easier to quickly determine your profit and loss. You should be keeping track of stock, inventory of products or parts so you can calculate cost of goods sold.

Income Tracking

Your cash flow has to be accurately represented even if it’s a negative. It’s also important to know whether your company is using accrual (products or services are invoiced to a customer) or cash-basis accounting. The type of accounting you use will determine which recent transactions count as income for the current year and which are saved for next year’s taxes.

Separate Personal & Business Expenses

Expenses need to be categorised and separated as business or personal. Ideally, you’d want to have a separate business account, but if you don’t, this is incredibly important.

Deductions

Deductions such as mileage, travel, clothing and home office should be tracked throughout the year and claimed in your return. Capital expenses like machinery can be depreciated over a longer period of time.

Reporting

You should have available the right data at the right time. Year-to-date (YTD) reports, payment summaries, turnover, Profit & Loss Balance Sheets, liabilities and more. With comprehensive reports you can focus on and remove bad debts, prepare and lodge for the ATO, and stay on top of your obligations.

If this seems a little overwhelming and your growing in size, it might be time to look at investing in accounting software. SapphireOne Accounting Software saves you time by automating processes and prefilling statements for the ATO. SapphireOne’s secure connection is complaint and ensures lodging of BAS, payroll, super and tax is fast and accurate. Your end of year business tax return can be calculated after generating reports with all the necessary financial information from your one data file.

For more information on the capabilities SapphireOne ERP, CRM, DMS, Accounting Software application and how we can help you at tax time click here, request a demo or contact us.

SapphireOne achieved Full Certification Single Touch Payroll (STP) and Standard Business Reporting (SBR2) on 1st May 2018

May 3, 2018 3:24 pm | by John Adams

Based on the information provided SapphireOne has been assessed and given Full Operational Framework Approval for SapphireOne who are consuming BAS (PLS) and STP low risk API (payevent services) with the following terms and conditions.

API consumption conditions

Conditions

- Full Approval granted SapphireOne for BAS services (PLS) and STP low risk API (payevent services)

- SapphireOne have ISO certification with software stored and managed by the client, in accordance with our requirements MFA is not a requirement as the as they are Desktop application provider storing no data onsite.

Production Verification Testing (PVT)

You must successfully complete the required PVT scenarios with your Account Manager for each PLS API required.

Changes to your situation

The ATO must be notified via your Account Manager of any changes to your business or product environment, in relation to the information you supplied in your questionnaire.

Monitoring

Monitoring is considered a joint responsibility between the ATO and the DSP.

The ATO conducts monitoring at the network, application and transaction layers; if anomalies or areas of concern are identified, we may re-assess your whitelisting suitability. The ATO will generally contact you or your representative unless exceptional circumstances apply.

Where you identify a breach through your own monitoring controls you must notify the ATO immediately via your Account Manager to ensure appropriate action can be taken.

Please respond with your agreement, understanding and acceptance of the conditions contained within this email.