7 Steps to Conquer EOFY (Financials and Assets)

July 1, 2020 8:44 am | by John Adams

If your financial year ends on 30 June, the sticky notes on your desk are by now likely taking over any leftover free space that you were hoping to preserve this time around. EOFY season is traditionally stressful and the additional challenges brought upon businesses by COVID-19 are considerable. But fear not, we are here to help you. This blog is intended to give you a concise to-do list for running Financial and Assets Year End in SapphireOne.

Please note that processing Payroll Year End is a little different than the procedures needed for Financials and Assets. In our previous blog, we provided a step-by-step guide for a smooth roll over of your Payroll into the next tax year.

You do not need to close your financial year at a specific date and financial Year End can be processed well into the next year. However, you may be legally required to perform an annual stocktake for tax purposes by 30 June. Therefore, many companies choose to run Year End for Assets and Financials separately. If you perform the rollover procedures at different times, you will have to re-run some of the steps.

1. Run Month End

- Send Statements

- Review Budgets

- Record Asset Depreciation

- Lodge BAS/IAS Submission

- Review all essential Reports

- Reconcile any other information with source documents available to you

2. Perform Stocktake

3. Backup of Data File

4. Conduct Data Maintenance

5. Unlock all Periods

6. Process Year End

- a. Assets

- Producing all Reports

- Checking all Depreciation is up to date

- Enter the last period for the year (e.g. “12” if you run a 12-period-year)

- Tick all completed checkboxes and click “continue”

- b. Financials

- Post all Transactions

- Reconcile and Print –

- Trial Balance

- Standard Balance

- Income Statement

- Balance Sheet

- Aged Clients and Aged Vendor Balances

- Reconcile Bank Accounts with Bank Statements

- Run GL Audit Report

- Finalise Statements

- Verify and Complete all Client and Vendor Allocations

- Enter the last period for the year (e.g. “12” if you run a 12-period-year)

- Tick all completed checkboxes and click “continue”

7. Check Periods

- “Assets” once you have run Assets Year End

- “Clients, Vendors, Time Sheets, Sales Analysis, General Ledger and Projects” once you have run Financial Year End

Make sure that all month end tasks have been completed for Financials and Assets. These include:

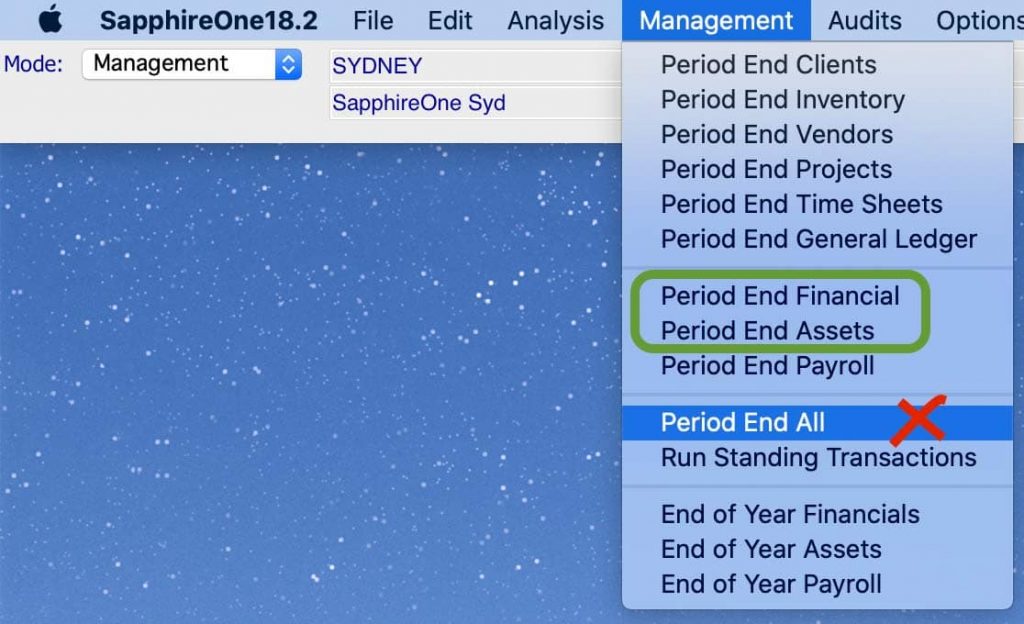

In most Instances at the end of a financial year you will have run Payroll Month End and then Payroll Year End earlier than you would need to Financials and Assets, as you cannot process any new Payruns for the new financial year until this has been completed (Payroll Year End Blog). Therefore we recommend running “Period End Financials “ and “Period End Assets” separately if this is the case. Alternatively if you are ready to process Month End for your Financials and Assets before you process a new Payrun in the new Financial Year then you can run Month End All, followed by End of Year Payroll and then it is possible to process End of Year Financials and Assets when you are ready.

Australian tax law requires you to record the value of all your trading stock on hand as at the end of your income year (30 June). For this purpose, you need to keep records of all transactions related to buying, maintaining, repairing and selling business assets or stock in order to be able to substantiate any amounts and values stated in your tax return.

A Stocktake is performed once all transactions affecting inventory quantities and values for the financial year have been entered and posted so before you commence stocktaking, make sure you have finalised all transactions.

Once you are prepared to undertake financial Year End, it is mandatory to create a master backup of your data file. Also verify that the backup can be read and store it in a safe location before rolling.

Minimise the chance of any errors occurring by running the Re-Index on your SapphireOne server and ensure a Data Compact has been done.

For extra precaution, you can run the Year End procedure on the Single User application with a copy of your data file beforehand to familiarise yourself with the process and to avoid any adverse results when running it on your live data file.

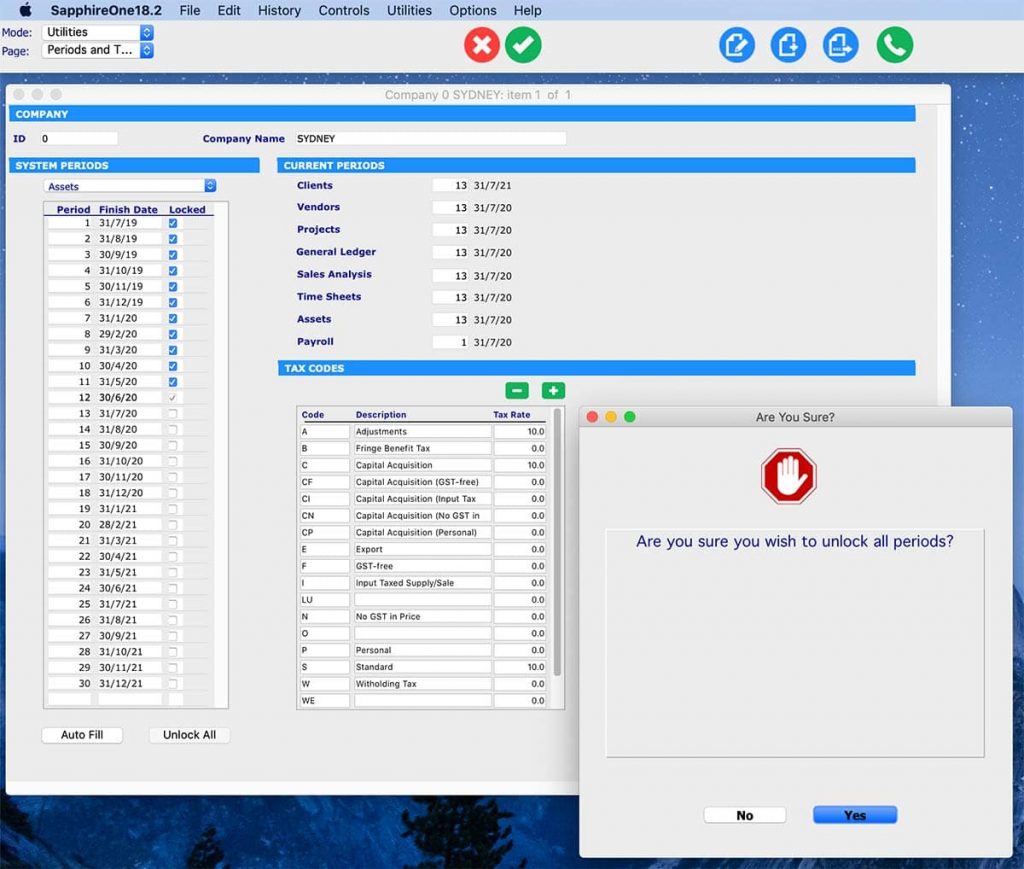

For processing Year End all periods need to be unlocked. Note that you need to do this for all seven functionalities in the dropdown (but not for Payroll).

Go to: Utilities > Controls > Company > Page: Periods and Taxes > Select Unlock All

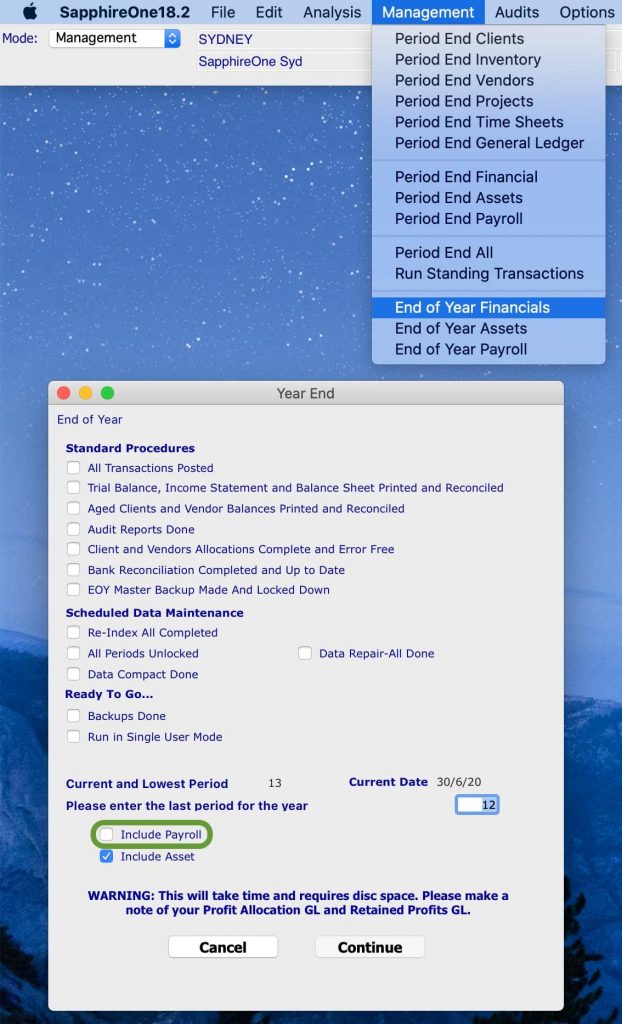

You have the option to run Year End Financials and Assets simultaneously if you have finalised all required steps for both modules at the same time. All you have to do for this is tick “Include Asset” when opting for Year End Financials.

However, it is very important to remember not to tick “Include Payroll” as you will have most likely already run Payroll Year End previously.

Commence your EOFY processing for Assets by:

Then go to: Management > Management > End of Year Assets

Note that you cannot post your depreciation for the first month of the new financial year until you have rolled over.

Perform the EOFY Rollover Procedures for Financials by:

Then go to: Management > Management > End of Year Financials

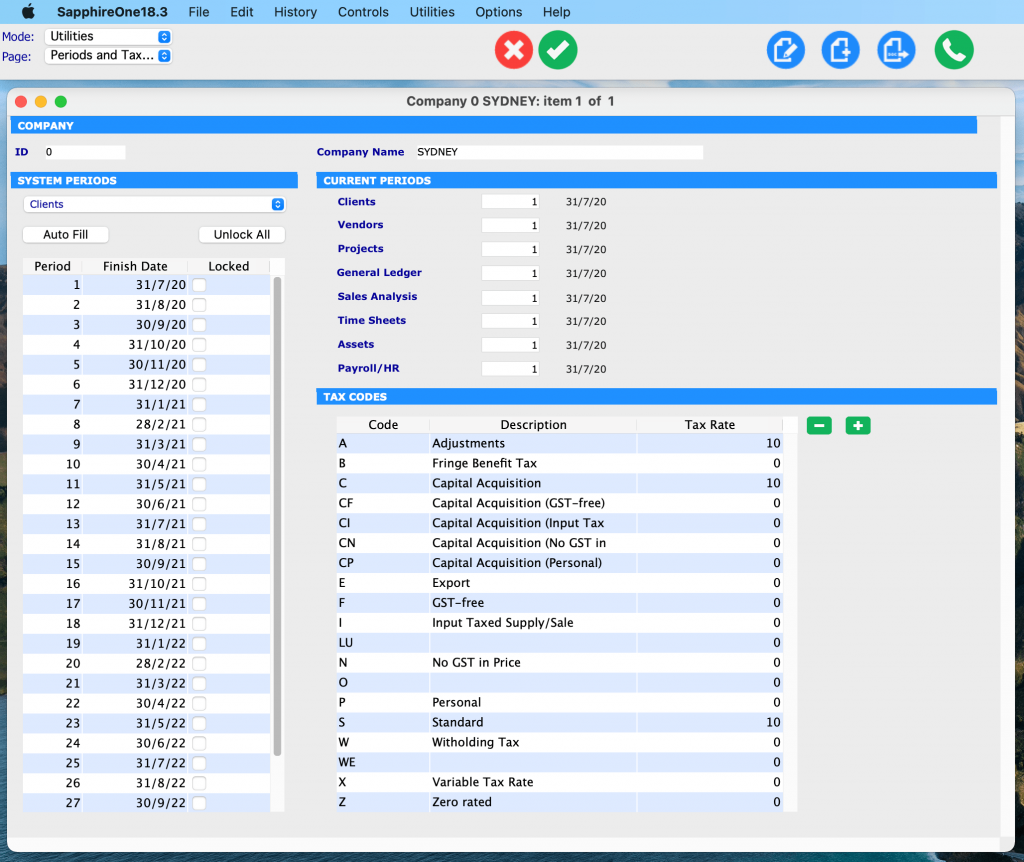

Once you have successfully run your End of Year for Financials and Assets, you need to check the periods.

Go to: Utilities > Controls > Select the Company > Page: Periods and Taxes

There is a total of seven functionalities in the dropdown that you need to check the periods for:

Make sure that period 1 is the correct finish date according to your data file. In the example below, period 1 ranges from 30 June 2020 to 31 July 2020.

It is easy to lose oversight of all the administrative tasks that need to be performed during EOFY and it pays to be prepared.

Please make sure to follow our instructions above so that financial Year End is smooth sailing for you and your team. Our friendly support team is also available to give you a helping hand. All you need to do is book a support call with us!

You can find year-end deadlines and more information on this ATO page.