Frutex has been stocktaking smoothly with Sapphire WebPack

June 26, 2020 11:06 am | by John Adams

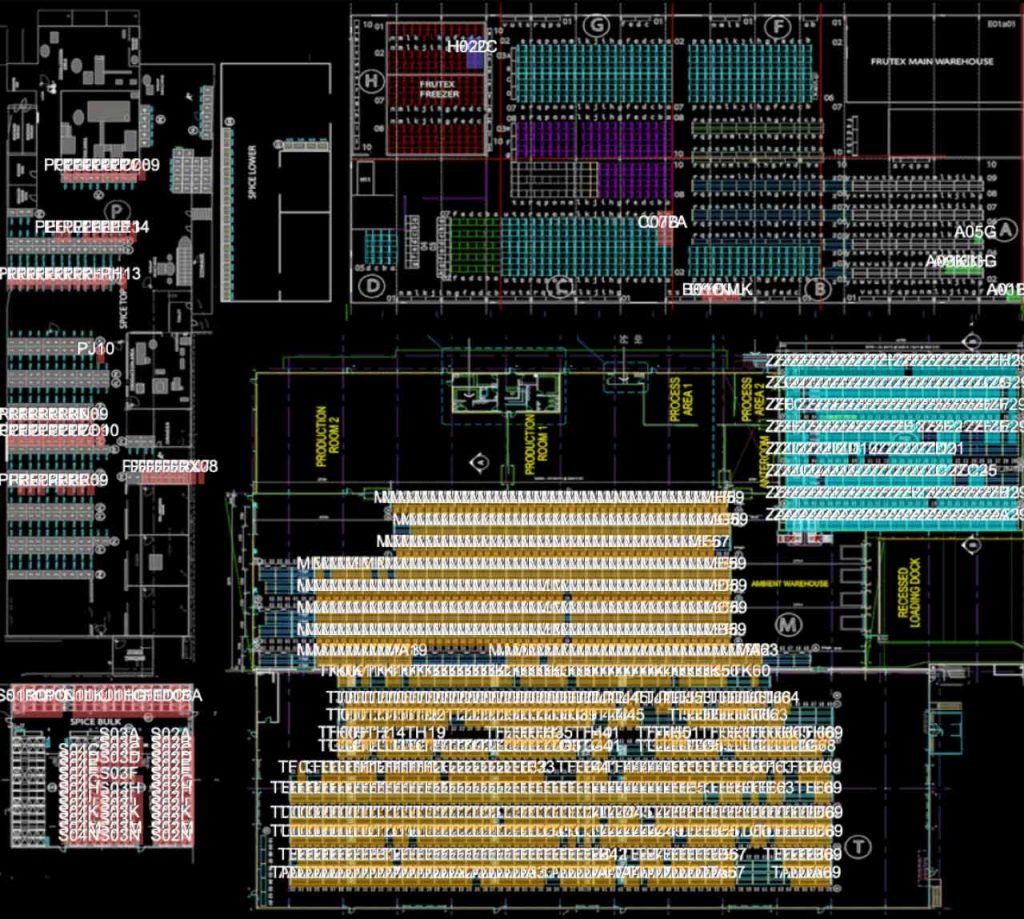

Frutex's Frozen Stocktake section (-20℃)Frutex, who has been a client with us since 1999 is currently getting ready for EOFY. Their site entails 60,000 square metres with total of seven warehouses. The company is a technology leader in the food industry, investing heavily in state-of-the-art plants and equipment.

Harry, who is the IT & Marketing manager of Frutex, says:

“Heads up, we are stocktaking today using SapphireOne’s new improved multi-warehouse support, with live stocktake visual map updates, which shows us what’s been counted as we go along…. it’s been great working with the SapphireOne team who have worked tirelessly over the last couple of weeks to make this possible for us.

We recently built a new warehouse / freezer / production facility that adds over 12,000 pallet spaces to our warehousing that is now a total of 44,000 pallets of dry and frozen storage.

Using Sapphire’s WebPack we are able to stocktake the entire facility in 2 days, with 15 teams of stocktakers working simultaneously on iPads, we also have recently installed a new 10G ubiquity network utilising over 100 UniFi devices with 100% site Wi-Fi coverage and over 100 surveillance cameras monitoring the site. The entire operation is easily managed by a very small IT team and monitored via iPad and iPhone apps.”

Frutex is a user of the Sapphire custom Web Pack, which is fully integrated into all company warehouses and offers warehouse mapping as a functionality. This allows all stock to be tracked and viewed live on portable iOS devices over a company’s Wi-Fi. Their stocktaking incorporates a total of nine locations.

For more information about all the benefits of SapphireOne’s integrated ERP, CRM, DMS and Accounting Software solution, sign up for a live demo with us. Here you can also read more testimonials from our long-standing clients.

Documents for Tax Return you need to file

May 31, 2019 3:40 pm | by John Adams

Tax can be stressful and with the end of year tax return approaching fast, it’s best to start planning to avoid the headache. Your tax return reveals insights on how your business is performing. Decisions can be made on investments opportunities, where you can cut costs and opportunities arising to maximise profits. Super, GST and ATO reporting are all part of your tax obligations, so what documents for tax return do you need to make sure are lodged properly?

6 requirements of your business tax return

Not every business will have same requirements. Here are a few fundamentals that need to be calculated, and documents for tax return that are necessary to lodge a successful one.

BAS and PAYG reporting

Have you been lodging your Business Activity Statement BAS, via SBR2 Pay-As-You-Go PAYG and superannuation throughout the year? Single Touch Payroll STP also became mandatory on the 1st July 2018 for companies with over 20 employees as the new way of paying wages. Your BAS reporting should be monthly or quarterly and its important they are accurate and efficient.

Expense tracking

When it comes to expense tracking, make sure your data is up-to-date and categorised. This will make it easier to quickly determine your profit and loss. You should be keeping track of stock, inventory of products or parts so you can calculate cost of goods sold.

Income Tracking

Your cash flow has to be accurately represented even if it’s a negative. It’s also important to know whether your company is using accrual (products or services are invoiced to a customer) or cash-basis accounting. The type of accounting you use will determine which recent transactions count as income for the current year and which are saved for next year’s taxes.

Separate Personal & Business Expenses

Expenses need to be categorised and separated as business or personal. Ideally, you’d want to have a separate business account, but if you don’t, this is incredibly important.

Deductions

Deductions such as mileage, travel, clothing and home office should be tracked throughout the year and claimed in your return. Capital expenses like machinery can be depreciated over a longer period of time.

Reporting

You should have available the right data at the right time. Year-to-date (YTD) reports, payment summaries, turnover, Profit & Loss Balance Sheets, liabilities and more. With comprehensive reports you can focus on and remove bad debts, prepare and lodge for the ATO, and stay on top of your obligations.

If this seems a little overwhelming and your growing in size, it might be time to look at investing in accounting software. SapphireOne Accounting Software saves you time by automating processes and prefilling statements for the ATO. SapphireOne’s secure connection is complaint and ensures lodging of BAS, payroll, super and tax is fast and accurate. Your end of year business tax return can be calculated after generating reports with all the necessary financial information from your one data file.

For more information on the capabilities SapphireOne ERP, CRM, DMS, Accounting Software application and how we can help you at tax time click here, request a demo or contact us.

Simplifying the concept of end of financial year

July 11, 2018 10:34 am | by John Adams

The Australian financial year typically starts from 1st July and ends on 30th June. The 30th June is also known as end of financial year when businesses start preparing their financial reports in order to submit their financial position to the Australian government. In New Zealand the end of financial year is on 31st March, in the United States of America the financial is typically the last Friday of December.

Documents needed for end of financial year

A range of documents are needed to assess the tax obligations of your business such as Income Statement, (also known as the Profit and Loss P&L) and Balance sheet.

The objective of financial statements is to provide information about the financial position, performance and changes in financial position of an enterprise that is useful to a wide range of users in making economic decisions. Financial statements should be understandable, relevant, reliable and comparable. Reported assets, liabilities, equity, income and expenses are directly related to an organization’s financial position.

Countries over time have developed their own accounting methods and principles, making international comparisons of companies difficult. To ensure comparability and uniformity between financial statements prepared by different companies, a set of guidelines and rules are used. Commonly referred to as Generally Accepted Accounting Principles (GAAP), these set of guidelines provide the basis in the preparation of financial statements.

SapphireOne ERP CRM DMS can support unlimited number of companies in unlimited tax jurisdictions in one data file. SapphireOne also support multiple foreign currencies and unlimited number of foreign bank accounts, supporting all your foreign exchange (FX) requirements.

Income statement / Profit and Loss (P & L)

The Income Statement or Profit and Loss (P & L) measures a company’s income and expenses during a specified period of time. A profit and loss statement provides information on the operation of the enterprise. These include sales and the various expenses incurred during the stated period.

The Income Statement is one of the most important financial statements a business or organisation issues annually, along with the balance sheet and the cash-flow statement.

SapphireOne ERP CRM DMS has the ability to run the current year versus last year reports, or if required up to ten years historical data on the one report.

SapphireOne also has the ability to copy last year’s actual general ledger balances into the current year’s budget.

Balance sheet

The company Balance Sheet represents company’s financial position, which is important at the end of financial year. The Balance Sheet outlines the total assets, liabilities and owner’s or stockholders’ equity at a specified point in time. Assets the business owns, such as vehicles, plant and equipment, property, intellectual property and cash in the bank are included on the Balance Sheet, depreciation of these assets is included on the Income Statement (P&L). Liabilities include your creditors, payroll obligations such as employee’s annual, carer and long-service accrued leave.

SapphireOne ERP CRM DMS financial reporting has the ability to export data to spreadsheet and also import data to the general ledger budget via the Sapphire API gateway.

For a sneak peek at the full capabilities ERP, CRM, Accounting Software, Human Resources, Payroll, Assets and Document Management, check out SapphireOne and request a live demo, it is everything you’ll ever need to make your company management a success. Know more about us.