Are You Ready for Payroll Year End?

June 16, 2020 11:20 am | by John Adams

Preparing and processing your Payroll Year End only takes 8 simple steps and by following them closely, you will smoothly roll over into the new financial year.

COVID has turned the world upside down in 2020 in so many aspects. From an accounting perspective, Payroll has had to carry the brunt of it with the introduction of JobKeeper. On top of that, employees have chosen to sacrifice parts of their salaries in order to help struggling companies survive during these unprecedented times.

If you are working within Payroll, it is understandable that Payroll Year End has been the least of your worries. However, small mistakes can lead to dire consequences. Not to worry though – we have got you covered! In this blog, we are providing you with guidance on how to get your business prepared for Payroll Year End.

- Review of Balances and Settings

- Reconciliation of Posted Pay Run

- Run Final Pay Run

- Finalise STP Declaration

- Run End of Month

- When you have started a new pay in period 12, do not process it in period 13. Run Payroll Year End first and then process it once you are in period 1 of the new financial year.

- Do not post your last Payroll of the financial year after processing Year End.

- Post Payroll Year End

- Update Periods and Taxes

- Import Tax Scales

Before processing your final Pay Run, make sure that you have revised your closing balances and all of your Allowance settings, especially if something was altered in 2019/20. During this process, you can also go through all current employees’ payroll details and payments to ensure they are up to date.

If you are claiming JobKeeper payments and are a little worried that you are not complying with the ATO’s criteria, have a read through our JobKeeper step-by-step guide.

Use Payroll Year End as an opportunity to revise any of your company’s checklists and reports that make up your workflow to ensure that all your prior reconciliation activities for posted Pay Runs in 2019/20 have been flawless.

We also recommend at least verifying the General Ledger Audit, Transactions Audit and Trial Balance.

Now process your last Pay Run of the financial year as you usually do on a weekly, fortnightly, or monthly basis.

Every time you process a Pay Run, you also have to submit your STP Report to the ATO and SapphireOne automatically transfers all employees’ tax and super information.

However, when it comes to Payroll Year End, the ATO requires an additional STP finalisation declaration. It entails the confirmation that Payroll Year End has been completed for the current financial year and that all values are final.

If you employ 20+ employees, the declaration is due on the 14 July. If your company has 19 or less employees, you have until the 31 July to declare your STP Finalisation.

Luckily, submitting it only requires a couple of quick and easy steps in SapphireOne:

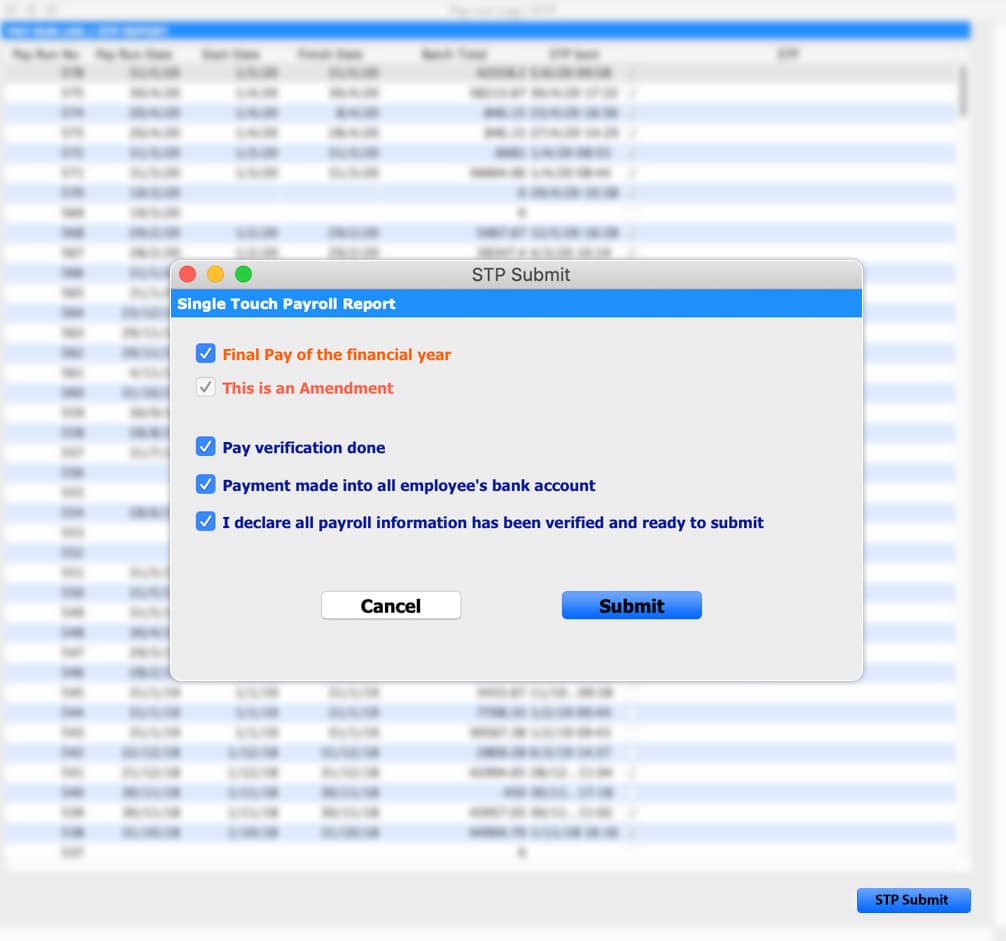

Go To: Payroll/HR > History > Pay Run Log / STP

Click on: STP Submit

In pop-up window: Tick “Final Pay of the financial Year” and confirm and tick the 3 declarations below it

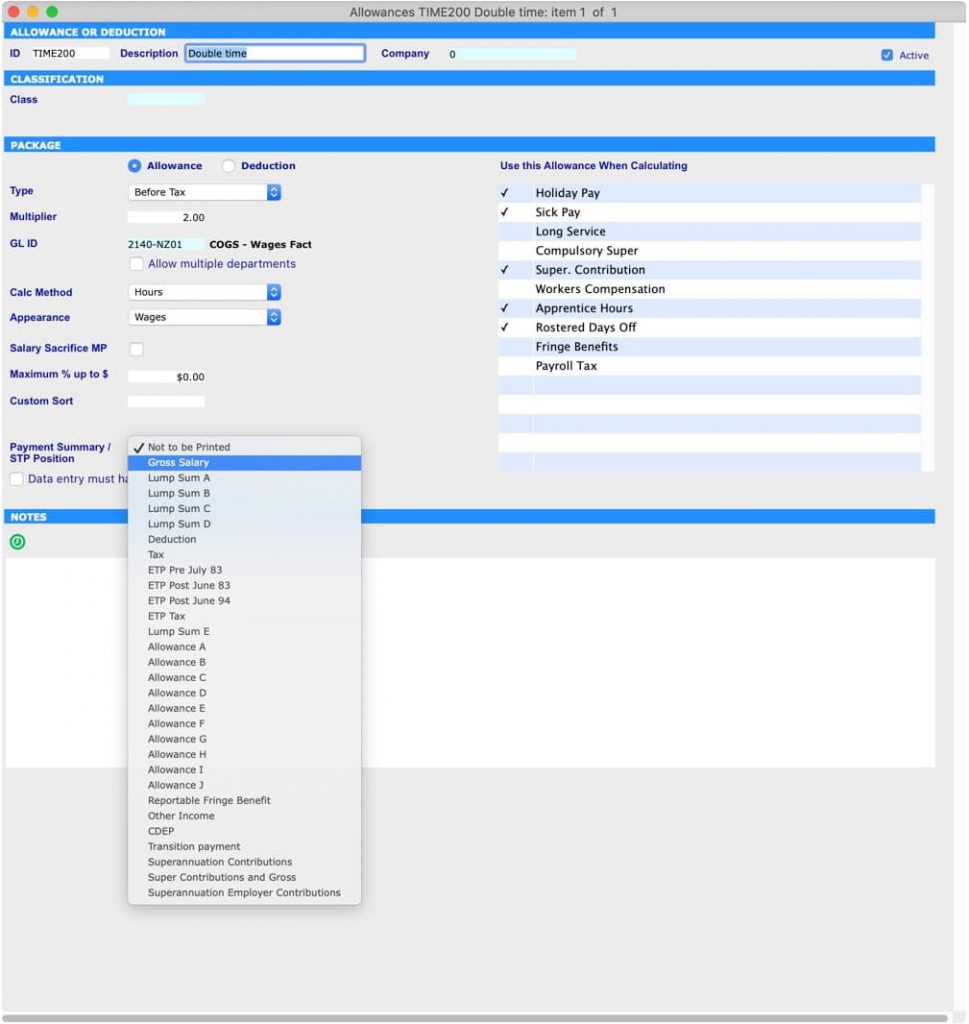

The option of re-submitting the STP Report with opting for “This is an Amendment” only applies for category changes in the Allowance settings (Payment Summary / STP Position).

For example, if you have added an additional allowance in 2019/20 but did not set it as Gross Salary by default, it is set as Not to be Printed and it will not be reported to the ATO. Note that the amendment option is not intended for re-submitting any alterations in your Payroll figures after you have reversed a Pay Run.

It is very important that you run Period End for Payroll for the last month of your financial year before processing your Payroll Year End, otherwise you will end up in the wrong period!

This means that when running your Payroll Year End, your Payroll will be in period 13. Your last Pay Run for the financial year has to be in period 12 and not in period 1 or period 13.

Important things to remember:

Remember that your Payroll period is different to that of your Financials. When Payroll is in period 12, your General Ledger and other financials may be, as an example, in period 12 or 24.

It is vital that you review your final Pay Run results before you submit your Payroll End of Month as you cannot correct any errors in your data entry afterwards. This is due to the fact that SapphireOne has now implemented a security mechanism preventing Pay Runs to be processed in the wrong financial year. Once you have run Month End to roll from period 12 to period 13, you cannot reverse and re-run Payroll in period 13.

Your Payroll is now all set for processing Year End. As a reminder, verify that your Payroll is, indeed, in period 13 and not still in period 12 or already in period 1.

Go to : Management > Management > End of Year Payroll

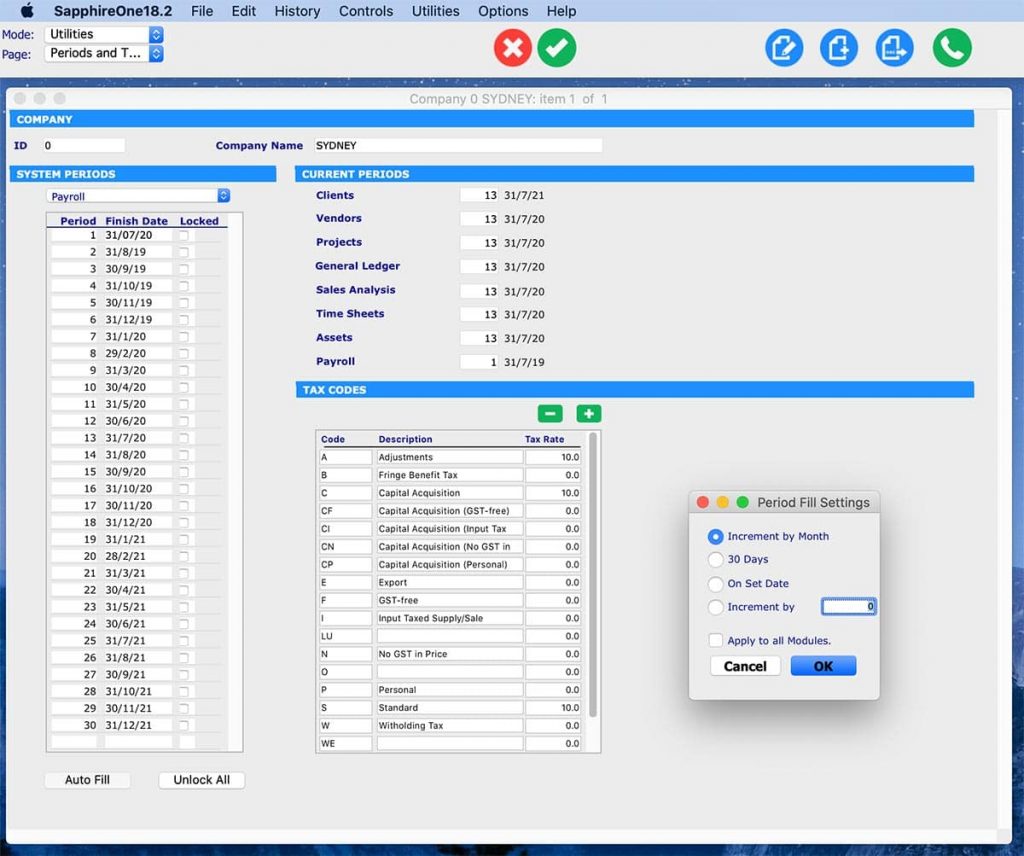

Once you have successfully posted your End of Year Payroll, you need to update the periods and taxes for Payroll.

Go to : Utilities > Controls > Select the Company > Page: Periods and Taxes > Select: Payroll > Manually change the Finish Date for Period 1 to the next Payroll year.

For example, as we were in 2019 you will have to set it to 2020 for the current year. By selecting “Auto Fill” (Select: Increment by Month) the year will be adjusted automatically for all other periods in the screen.

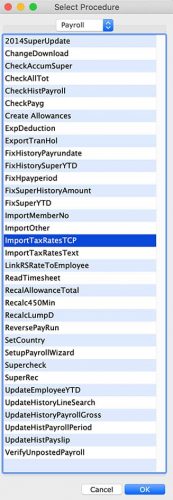

You are almost done! The last step requires you to import the tax scales for Payroll if they have been updated already.

Once the ATO releases the new tax rates, you will receive a reminder email from SapphireOne to make sure that you import them into your system.

Go to : Utilities > Utilities > Sapphire Functions > Dropdown: Payroll >

Then select: ImportTaxRatesTCP (or Text, if required)

We at SapphireOne are here to support you through the procedures to make sure your Payroll Year End runs smoothly. If you have any questions or need any further assistance, please book a support call and our friendly IT support team will help you out!

Seamlessly manage payroll for multiple companies with SapphireOne ERP

February 26, 2020 8:50 am | by John Adams

Many ERPs on the market today deploy a single functional system and interface it with bolt on modules. This can become expensive to implement in the long term as each individual module attracts its own costs and licensing. SapphireOne is all-inclusive, providing access to every module via a single toolbar.

SapphireOne leverages off the database backend, providing unlimited numbers of concurrent users with real-time access and optimal processing speeds with no data file size restrictions. With our user-friendly ERP system, your employees will be able to extract custom reports with ease. These reports will enhance and improve your daily workflows.

Multi Company Payroll is a Standard feature of SapphireOne

SapphireOne is true multi-company, housing unlimited companies, currencies and tax realms within the one data file. SapphireOne is built with your growth in mind with the ability to process multiple payrolls in multiple companies as a standard functionality. SapphireOne’s single toolbar provides instant access to your employees vital data.

Delivering payslips instantaneously on payday. This is required by Fair Work Organisations and is a breeze with SapphireOne. At the click of a button Payslips are delivered via email delivery system in a secure, best practice format.

Easily process payroll across multiple companies

SapphireOne’s advance functionality allows you to process payroll across multiple companies. This eases the challenges of managing your team, and efficiently manage HR to ensure your business is compliant with all federal laws and regulations.

SapphireOne’s standalone and fully integrated multi company payroll system saves time , lowers payroll management costs and makes better use of your valuable employee time and data.

On occasions you may have to allocate your employees costs across multiple companies, you will have to ensure that you have the locations set up within your company’s profile. You will also need to ensure that employee/s working at multiple companies have the relevant locations allocated to their profile’s within the system, so they are available to have hours/costs credited to the location/s. This will help you to split the cost across multiple companies.

A flexible Payroll System

SapphireOne Payroll system is very flexible. Our built-in and comprehensive leave request functionality streamlines all leave requests. It also streamlines approval processes with an inbuilt workflow, with unlimited stages and unlimited levels within each workflow stage. The workflow can have a unique electronic signature at each stage and each level.

SapphireOne’s payroll caters for multiple pay cycles including weekly, fortnightly, bi-monthly, 4 weekly, monthly and one-off payments.

SapphireOne calculates the gross wages, Pay as you Go (PAYG)/Pay as you Earn (PAYE), superannuation contribution and take-home pay. You can then pay your employees directly across multiple companies by simply initiating the payrun from SapphireOne multi company Payroll System. While using multi company payroll functionally, you can process Single Touch Payroll (STP), the process is identical as if you are doing a single company entity. The only difference is for multi company you have to process STP separately for each company.

The fully featured and flexible SapphireOne Payroll supports payroll for full-time, part-time, casual, contract and directors. SapphireOne is a truly multi-company payroll application and with this you can run multiple companies in different countries, tax jurisdictions and currencies using a single data file.