2022 Premier’s NSW Export Awards Finalist

September 29, 2022 10:17 am | by John Adams

The SapphireOne team is proud to announce that SapphireOne is a finalist for the 2022 Premier’s NSW Export Awards. SapphireOne is running in the category of Advanced Technologies, highlighting SapphireOne’s achievements in the international market and recognising the ‘success and resilience’ of exporters in New South Wales.

We have had many significant achievements and accomplishments this year. In particular, the SapphireOne Knowledge Base, Single Touch Payroll Phase II certification, and the development and release of SapphireOne 19.4.

The latest version of SapphireOne 19.4 contains significant upgrades and updates, also making SapphireOne 19.4 the first ERP to be fully compatible with Apple Silicon.

Members of the SapphireOne team will be attending the NSW Export Awards on the 12th October 2022. Additionally, the winners of the 13 national categories in this program will be moving forward to the Australian Export Awards. Consequently, the pathway to enter the National Export Awards is through your respective State or Territory awards program only.

Celebrating 60 Years of Australian Export & Investment Awards

The Australian Export & Investment Awards run by the Australian Export Council is one of the longest running business awards programs in Australia. Now in its 60th year, the awards is a national program recognising and honouring Australian exporters. Furthermore, these exporters are achieving sustainable growth through innovation, and international companies making an enduring contribution to the Australian economy.

The Australian Trade and Investment Commission and the Australian Chamber of Commerce and Industry partner to present the award program. It’s a high priority of the Australian Government and is supported by leading Australian corporations, export facilitators and industry groups.

Equally, the program aims to recognise the success and resilience of NSW exporters and their achievements in the international market. They are announcing the winners of the 13 national categories on 12th October 2022.

Thank you to the Export Council of Australia for recognising SapphireOne, and congratulations to all the finalists!

In addition, we would like to acknowledge the support expressed by all partners:

NSW Government, Export Council of Australia, DHL, Department of Foreign Affairs and Trade, Export Finance Australia, BDO, AusIndustry, Austrade, KPMG.

1 day left to replace your AUSKey with your myGov…Better Security and more flexible

March 26, 2020 1:07 pm | by John Adams

AUSkey will be replaced by myGovID and Relationship Authorisation Manager (RAM) at 11.59pm AEDT on Friday 27 March, 2020. Together, these services give you a secure, simple and flexible way to access government online services.

myGov ID is an easy and secure way to prove who you are online. Relationship Authorisation Manager (RAM), lets you manage who can use online services on behalf of your business. These two services makes accessing government online services, easier and more secure.

Important Notice for SapphireOne Users – Replace your AUSKey

If you are using the SapphireOne ERP System then you will be be using Single Touch Payroll (STP) functions or Business Activity Statement (BAS) through Standard Business Reporting (SBR). It is very crucial that you replace your AUSkey to myGovID today. If you do not replace it before 11.59pm AEDT on Friday 27 March, 2020 then you will no longer be able to use these services.

Steps for replacing AUSKey to myGovID

Step 1 :

If you already have myGovID then you are already one step ahead. If you don’t have myGovID then do the following:

- Download myGovID app from App store or Google Play and create myGovID

- Verify your email address as directed

- Achieve a Standard identity strength by verifying 2 documents ( eg: passport, driving licence )

- Scan your ID documents or enter details manually

- Your myGovID should be ready to use

When you enter your credentials to login in myGovID using your Windows PC or Mac via your browser like Safari, Firefox or Google chrome, the system will send a 4 digit code in your myGovID mobile phone application. You will need to enter that 4 digit code or Accept it, in order to securely access myGovID.

Step 2 :

To get started with Relationship Authorisation Manager (RAM), first the principal authority needs to set up their myGovID and link to their Australian business number (ABN) in Relationship Authorisation Manager (RAM). Once linked, they can set up authorisations for employees and others to act on behalf of the business who will accept the authorisation in Relationship Authorisation Manager (RAM).

To get started visit – https://authorisationmanager.gov.au/

From here you will be able to link your business, view and manage your business authorisations, accept an authorisation request, manage machine credentials.

Step 3 :

Machine credentials allow DSPs, businesses and registered tax and BAS agents to interact with ATO online services through their SBR-enabled software. Machine credentials are installed from Relationship Authorisation Manager (RAM) ( step 2) and used in your SBR enabled software. This performs the same function as an Administrator or Standard AUSkey in your software.

Before you create a machine credential

Before creating a machine credential, you need to download and install the browser extension software compatible with your device’s operating system:

Windows – Chrome and Firefox

MAC OS – Chrome and Firefox

Below is the detailed guideline for installing Machine credential from the ATO.

Installing a machine credential guide

This guide provides step-by-step instructions on how to create a new machine credential for an entity in Relationship Authorisation Manager (RAM).

Step 1 – Using Chrome or Firefox, go to authorisationmanager.gov.au and select the myGovID login button.

Step 2 – Log in using your myGovID by entering the email address that you used to create your myGovID.

A code will appear. Open myGovID on your smart device, log in and enter the 4 digit code into the pop-up within the app. Tap Accept.

Step 3 – Click View or manage authorisations, machine credentials and cloud software notifications. You will be directed to a view of all the entities you can act on behalf.

Step 4 – Select the entity you would like to create a machine credential for.

Step 5 – The entity homepage will be displayed with a list of all the authorisations for the entity. Click the Manage Credentials tab in the toolbar.

Step 6 – The Manage credentials page is displayed. If you’ve already installed the required browser extension, go to the next step. If you have not yet installed the required browser extension, a message advising that browser extension software is required will appear.

Step 7 – Select Create machine credential.

Step 8 – Enter the following information:

- Keystore path – This will be pre-filled but can be changed if required. This is where the machine credential will be created and stored.

- Keystore password – Choose a password. It should include at least 10 characters with no space, an upper case letter, a lower case letter, a number and a punctuation character. You’ll provide this password within your software either when setting up or authenticating. You are not required to use your myGovID password for the ‘Keystore password’.

- Verify your keystore password.

- Credential name – Enter a name for the machine credential. You should create a name which will help you to easily identify the machine credential.

- Identify the Machine Credential Custodian – This will be pre-filled with your name and cannot be changed.

Tick the box to confirm you understand and accept the machine credential details. Click Download.

Step 9 – Click finish and your credentials have been installed.

Step 10 – From the Manage credentials page you can create, view, revoke and claim unassigned machine credentials for the entity.

For more details Visit – https://softwaredevelopers.ato.gov.au/usingmygovidramandmachinecredentials

How to Upload Machine Credential into SapphireOne

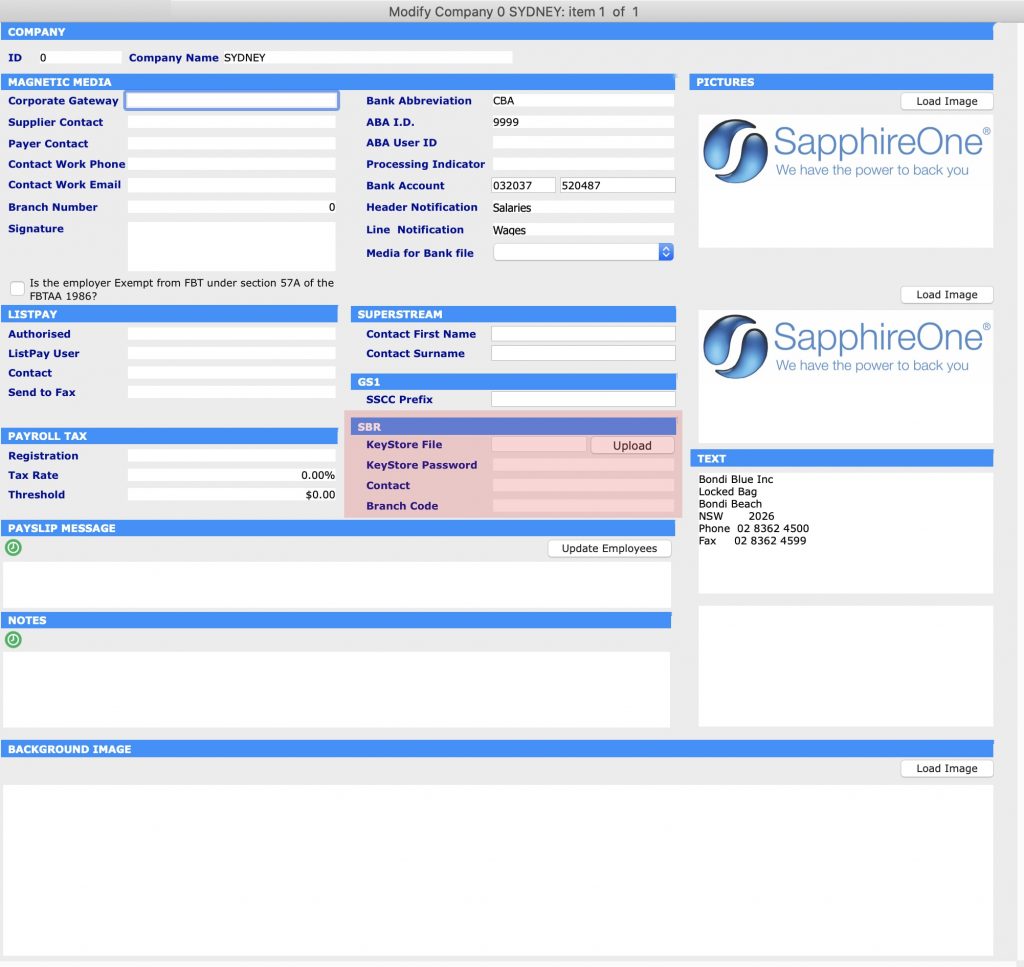

In order to upload the Machine credential into SapphireOne Go to Utilities > Controls > Company

Then click & modify the company where you want to upload Machine Credential. After that click More Details from the drop down menu.

Here in the middle of the screen you will see SBR section with an option to upload KeyStore file. Upload the Machine Credential file you have downloaded from authorisationmanager.gov.au and you will be ready to go.

ATO + SapphireOne = Relationship Authorisation Manager (RAM) to manage your company authorisations.

January 15, 2020 3:30 pm | by John Adams

Your AUSkey will retire in March 2020 and will be replaced with myGovID.

At the end of March 2020 your AUSkey will no longer be valid and will be replaced with your myGovID. Your myGovID can be managed using the ATO’s Relationship Authorisation Manager (RAM) – This will allow you to link your myGovID to your ABN and manage who can act on behalf of your business online.

You can already use myGovID and RAM for some participating government online services. This will extend to more government online services that use AUSkey or Manage ABN Connections.

Before you can submit a Single Touch Payroll event (STP) or submit a Business Activity Statement (BAS) through Standard Business Reporting (SBR), your AUSkey will need to be replaced by new machine credentials which are a component of the Machine to Machine (M2M) authentication solution.

Please click on the link below which explains how to create the machine credentials in the ATO Relationship Authorisation Manager which includes the steps you need to complete and details on installing the browser extension. There are several links to videos which will guide you through the process.

https://info.authorisationmanager.gov.au/business-software-user-or-provider

Machine credentials

The machine credential is installed on your computer and facilitates you to interact with the ATO online services through SapphireOne.

The

Machine credentials are created in the Relationship Authorisation Manager (RAM)

and replaces the AUSkey.

You will need to download and install the application plugin (Machine

credential download/browser extension) compatible with your computer’s

operating system:

Please note: Apple Safari, Windows Explorer, Microsoft Edge will not work with this plugin.

SapphireOne requirements are 17.2.1 or greater.

Please visit the Australian Taxation Office website for more details: https://info.authorisationmanager.gov.au

ATO system upgrades over Christmas & New Year time | STP and SBR will be unavailable

December 18, 2019 10:38 am | by John Adams

From midday AEDT on Tuesday 24 December 2019 ATO systems will progressively become unavailable until 6.00am AEDT on Thursday 2 January 2020 while ATO complete major system upgrades. This means during Christmas and New Year period starting from 24 December 2019 to 2 January 2020 ATO online services will be unavailable.

List of ATO online systems:

- ato.gov.au

- ATO app (some features)

- ATO Online services for Agents

- ATO Online services for Individuals and Sole Traders

- ATO Online services for non-residents

- ATO Online services simulator

- AUSid

- Australian Business Register

- Business Portal

- Bulk Data Exchange

- Data Transfer Facility

- Departing Australia Superannuation Payment

- EmployerTick

- Progress of Return

- Practitioner lodgement service

- Single Touch Payroll

- Small Business Superannuation Clearing House

- Standard Business Reporting

- Statement of tax record

- SuperTick

Access to STP, SBR and Payment will be limited

All SBR inbound services for the Practitioner Lodgment Service (PLS) enabled services will be offline during the closedown period. Single Touch Payroll (STP) will operate in a capture and store mode only. To support member rollovers, the SuperTICK service in single request processor (SRP) will remain operational across the full shutdown period. If you plan on working during Christmas & New Year time, your system access will be limited. You will be able to report using STP, but these records will not be processed or visible until ATO systems are available in the new year. You will not be able to lodge returns, activity statements and forms during this time. Payments via BPAY, EFT or Australia Post. will not be visible until the ATO systems are available.

SapphireOne advises that you process your payroll before 23rd December 2019 in order to avoid any kind of inconvenience.

Our office will close at 5pm on Monday 23 December 2019 and will re-open on Monday 6 January 2020 at 8.30am.

Merry Christmas and Happy New Year

Single Touch Payroll Software included in SapphireOne – no need for exemptions or deferrals

August 16, 2019 10:35 am | by John Adams

SapphireOne has been certified since 1 May 2018 with clients enjoying the free Single Touch Payroll software since 1 July 2018. Submission to the ATO is fast and reliable. SapphireOne continues to deliver a seamless transition to the new payroll system.

But for the ATO there has been problems. Confusion in the market surrounding the STP system, coupled with other payroll companies incomplete integration has led to employers being unable to submit. Extensions have been applied for employers with 19 or less employees. They can start reporting any time up to 30 September 2019. Deferrals from the ATO can also be requested.

Stress-free Single Touch Payroll Software in SapphireOne

SapphireOne Single Touch Payroll submissions are compliant, fast and efficient. Clients have been effortlessly communicating with the ATO since they announced the new way of reporting.

How to submit in SapphireOne:

- Go to Payroll Mode

- In the top tool bar go to History, Pay Run Log / STP

- Select the latest Pay Run and click STP Submit button in the bottom right of the screen.

NOTE: Often the ATO will not respond immediately and you will receive a message informing you of no results for the service. Close down and come back after 30-60 minutes.

Upon returning, go back into Pay Run Log and highlight the same Pay Run/ STP. Select the button – STP Get Result, located to the left of the STP Submit button.

You may need to return the following day if there is still no result as it can take up to 72 hours to get a result from the ATO.

When the STP report has been accepted by the ATO, you will receive confirmation alert – Report Submitted Successfully.

It’s that easy.

Common errors related to STP submissions

These occur when incorrect data is entered in the employee records. Examples are date of birth, postcode or suburb are missing, or invalid Tax File Number.

If you receive an ATO message relating to these fields, correct the data, select the Pay Run and click STP Resubmit button in the bottom right corner of the screen.

A pop-up screen will appear, tick the box – This is an Amendment.

It’s that easy.

Follow the links for more information regarding Single Touch Payroll in SapphireOne or for latest features of SapphireOne ERP, CRM, DMS and Business Accounting Software Application. Alternatively, contact our office on (02) 8362 4500 or request a demo.

Fringe Benefits and Super with Single Touch Payroll (STP)

July 12, 2019 12:25 pm | by John Adams

All Not For Profit organisations reporting through Single Touch Payroll (STP), can choose how they would like to report fringe benefits amount (RFBA) and employer super contributions (RESC). These fringe benefits are reportable if the total taxable value exceeds the threshold set by the ATO.

There are two options available through STP:

OPTION 1– If you choose to provide your employee’s RFBA and RESC amounts at each payroll or update event, you’ll need to include the amount for each pay run event and amounts for each subsequent payroll event, even if the amounts remain the same.

If you choose to provide your employee’s RFBA and RESC amounts at each payroll or update event, you’ll need to include the amount for each pay run event and amounts for each subsequent payroll event, even if the amounts remain the same.

OPTION 2- You can choose to provide RFBA and RESC amounts through an update event as part of the finalisation process at the end of the financial year.

Payment summaries

If you have chosen not to provide RFBA and RESC amounts through STP, you’ll need to:

- provide employees with this information on a payment summary

- submit a Payment summary annual report to ATO.

How to report fringe benefits and super with STP

If you use Single Touch Payroll (STP), your end-of-year reporting may be different for recording your employee’s:

- reportable fringe benefits amount (RFBA)

- reportable employer super contributions (RESC).

Where year-to-date RFBA and RESC are provided through a payroll or update event during the year, you’ll need to report these amounts for each following payroll event, even if the amounts remain the same.

Alternatively, you may report these amounts through an update event as part of the finalisation process at the end of the financial year.