SapphireOne Multi Company Accounting Software

April 21, 2021 11:24 am | by John Adams

If you are reading this you would already know that using integrated accounting software has become a necessity when it comes to effectively managing your business operations. But what if you own multiple companies, and want to manage all of them from the same accounting software?

Running your business and managing interests in two or more legal identities can be complex and complicated. With multi-entity accounting – plus the added consideration of multiple locations, currencies, regulations and tax jurisdictions – you have a plate full of things to track and manage.

Traditionally the way to manage this has been to manually prepare separate accounting for each – expenses, currencies, payments, tax returns, and often PayRoll – which can be incredibly time consuming and leaves you praying that your BAS returns, tax and financial information is balanced.

SapphireOne ERP, CRM and Business Accounting application has been designed to tackle these challenges for businesses, and is an integrated accounting software offering unlimited multi company accounting solutions at no additional cost. SapphireOne multiple company software provides global consolidation for multiple entities, locations and currencies – all at the click of a button.

Accounting software to manage multiple companies

SapphireOne multi company accounting software gives you the ability to manage multiple companies with multi-locations, operations, currencies and tax realms completely independent from each other. These are run through a single data file, which consolidates and automates all your businesses financial activities. The single data file means that you no longer have to exit out of one company’s database to work in another, simplifying accounts payables and spending across all entities by having one integrated accounting application to house all information.

With a single data file, companies can share clients, vendors and transactions. This means that the corporate head office can view accounts from all company locations. Employees can also access inventory, customer data, invoices, orders and documents on nominated companies from different locations and devices.

SapphireOne multi company accounting software prepares individual financials and business reports for each company, ensuring that all data remains within the one entity. For group financials and all areas of the business, access can also be limited to corporate head office and management to ensure data security and integrity.

PayRoll software for multiple companies

SapphireOne is an integrated accounting software application and includes eight separate modes within the one application. This includes the ability to process multiple PayRolls for multiple companies as a standard functionality within the application.

SapphireOne’s PayRoll software for multiple companies eases the challenges of managing your team across different companies, as well as managing HR requirements and ensuring you are compliant with all Federal and State regulations.

SapphireOne PayRoll software is the best PayRoll processing software for multiple companies as it provides the functionality to allocate your employees costs across multiple companies, set up all employee locations within a company profile, allocate employees working at multiple companies to the relevant location within the PayRoll system, credit hours and costs to specific locations, split costs across multiple companies, and much more.

Run unlimited companies at no additional cost

1. No additional licenses required

SapphireOne multi company accounting software is included within the SapphireOne application at no additional cost to the user. This sets us apart from our competitors, as SapphireOne users have the ability to run an unlimited number of enterprises within the one application for NO additional costs or license fees within a single data file.

In all relevant SapphireOne data entry screens, there is the multi company functionality that allows users to split transactions between multiple companies and projects. The multi company button is only visible if you have multiple companies set up within your SapphireOne data file.

2. Flexible multi-currency solutions

If you have multiple companies across the globe that need to buy and sell in the local currency, your ERP and accounting system needs to offer a flexible multi-currency solution. With SapphireOne multi company accounting software, not only can you specify a different currency for each location to buy and sell in, you can also choose the currency you prefer your information to display within the application.

3. Multiple Federal and State tax jurisdiction solutions

As a true multi company accounting software, SapphireOne is built to handle an unlimited number of companies that can sit within different Federal and State tax jurisdictions, have their own financial year-ends and trade in their own local currency.

4. Centralised multi company reporting

As SapphireOne multi company accounting software functionality is managed within the one data file, the software facilitates companies to share centralised data, providing easy access to all reports and data across multiple companies.

Simplify multi company accounting with SapphireOne

Multi company accounting software is a necessity for business owners managing multiple entities across multiple locations. After all, having all your accounting and payroll requirements for all your entities consolidated within the one application simplifies processes and ensures the smooth flow of information and functions across all areas of your business.

To find out more about SapphireOne integrated ERP, CRM and Business Accounting application and the benefits of multi company accounting software, please feel free to get in touch with a member of our team – we’re always here to help!

SapphireOne is now JobKeeper ready

April 28, 2020 10:43 am | by John Adams

The JobKeeper Payment is a wage subsidy made to eligible businesses, charities and not-for-profits affected by the Coronavirus to support them in retaining employees. Payments under this scheme are available from 30 March 2020 until 27 September 2020.

Employers that choose to participate in the scheme nominate all employees they are entitled to claim the subsidy for. It should be noted that this is an all in or all out optional decision for your eligible employees.

If you want to participate in the JobKeeper program, you can register your interest on the ATO’s website in order to receive updates and information on how and when to claim payments. It is advisable to enrol and pay your employees by 30 April 2020 in order to be eligible to claim the subsidy. However, if you need more time, you have until 30 May 2020 to enrol and nominate your employees.

Before you decide to process payments for JobKeeper in SapphireOne, you should understand the eligibility criteria, responsibilities of your company and payment information. Be aware that the ATO pays JobKeeper one month in arrears.

Eligibility criteria for JobKeeper Payment

In order to receive any payments under the JobKeeper scheme, both the employer and employee must meet all eligibility criteria.

For Employers:

Employers are eligible if they are businesses (including companies, partnerships, trusts and sole traders), not-for-profits and charities:

1. with a turnover of less than $1bn, if they have lost 30% or more of their revenue compared to a comparable period a year ago, or

2. with a turnover of $1bn or more, if they have seen at least a 50% reduction in revenue compared to a comparable period a year ago, and

3. there was at least one employee eligible on 1 March 2020, and

4. the eligible employees are currently still employed (including those who have been stood down or re-hired) during all relevant JobKeeper fortnights, and

5. the business is not listed in any of the ineligible categories

Example – Turnover test period

John runs a software company and he applies for the JobKeeper scheme during the first fortnight that the scheme started operating. This fortnight ends on 12 April 2020.

The turnover test period for John can be either:

• the month of March 2020 or April 2020, or

• the quarter from 1 April 2020 to 30 June 2020.

Example – Relevant comparison period

John identifies the relevant comparison period in 2019.

• For the month of April 2020, the relevant comparison period is April 2019.

• For the quarter of 1 April 2020 to 30 June 2020, the relevant comparison period is 1 April 2019 to 30 June 2019.

Read More from – https://www.ato.gov.au/general/jobkeeper-payment/employers/eligible-employers/

For Employees:

Employees are eligible if they are currently still employed and:

1. were employed by an eligible employer at 1 March 2020 (either full-time, part-time or fixed-term), or

2. were a long-term casual employee at 1 March 2020 (if they were employed on a regular and systematic basis for at least 12 months) and not working permanently for any other employer, and

3. were at least 18 years of age at 1 March 2020 (special rules for eligibility apply for younger employees), and

4. were an Australian resident (or if they are a holder of a Subclass 444 visa, were an Australian resident for tax purposes), and

5. did not receive either government parental leave, Dad and partner or worker compensation payments during the relevant JobKeeper fortnight.

Read More from –

https://www.ato.gov.au/general/jobkeeper-payment/employees/eligible-employees/

Responsibility of employers and employees

Employers need to give each eligible employee a JobKeeper Employee Nomination notice, informing them on the intention to participate in the scheme and asking for their approval to be nominated and receive payments under the program. These forms should be kept as records, but do not need to be sent to the ATO.

The notice can be accessed via following link:

https://www.ato.gov.au/Forms/JobKeeper-payment—employee-nomination-notice/

Additionally, the ATO requires companies participating in the JobKeeper scheme to make monthly declarations through the ATO’s business portal about their eligible employees and their turnover via STP and SBR2.

How much to pay

Every employer has to pay a minimum of gross $1,500 per fortnight to each eligible employee, withholding income tax as appropriate. If the wage paid to an employee exceeds this amount, the employer will regardless only be reimbursed for $1,500.

Employers are advised to pay their employees every fortnight under the JobKeeper scheme in order to maintain eligibility. The first fortnight runs from 30 March 2020 until 12 April 2020 and the last fortnight ends on 27 September 2020, respectively.

If an employee earns a wage of less than $1,500, their employer is only allowed to receive reimbursement under the JobKeeper program if they pay an according ‘top up’ in order to reach the value of gross $1,500 per fortnight. If the employer fails to pay this minimum amount to an eligible employee, he or she forfeits their claim under the subsidy scheme for the relevant fortnight.

All JobKeeper payments are considered assessable income of the eligible business. Further, the normal rules for tax deductibility apply in respect of the wages a company pays to its employees and for which they receive subsidies under the JobKeeper scheme. With regard to compulsory superannuation, the employer is not obligated to pay any super contributions for JobKeeper payments. Such payments are also not subject to GST.

How to Process JobKeeper Payments in SapphireOne

There are 5 steps needed to Process Payroll within SapphireOne for JobKeeper Payments for first time. You can skip step 1 – 3 every following time you make a payment under the JobKeeper scheme.

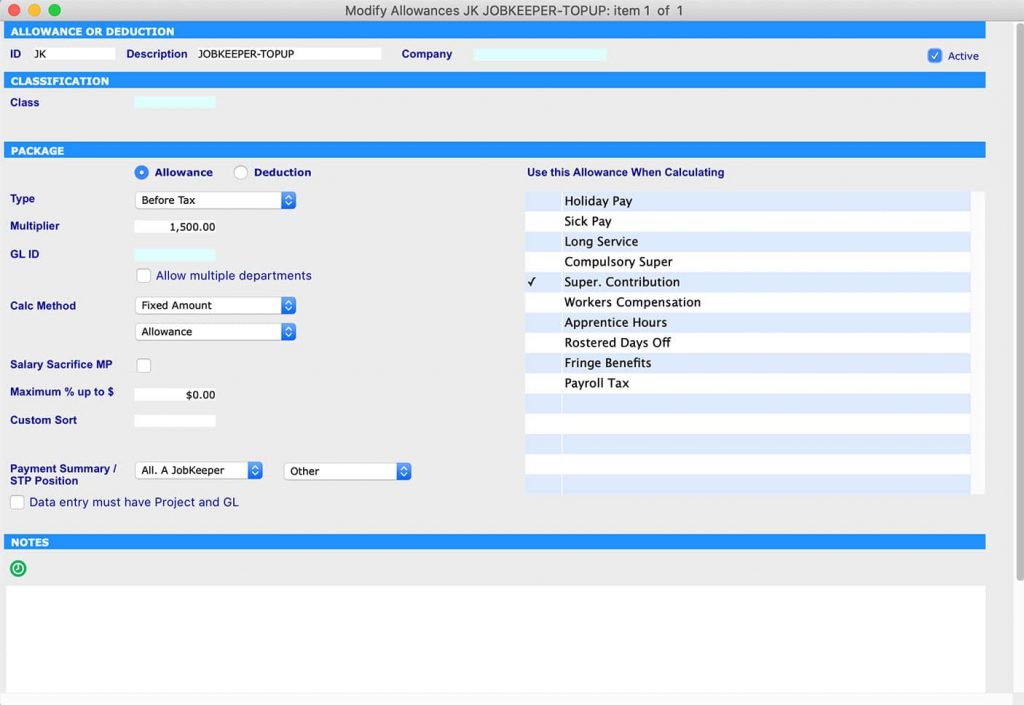

Step 1: Create new Allowance record for JobKeeper.

Go to: Payroll > Administration > Allowance > Create New

The new Allowance has to have the name “JOBKEEPER-TOPUP”. Make sure the Payment Summary Names are set up between “Allowance A” to “Allowance J” and the Payment Summary / STP Position is set as “Other”.

Example:

Type ID – JK

Description – JOBKEEPER-TOPUP

Type – Before tax

Multiplier – 750 (Weekly) or 1500 (Fortnightly) or 3250 (Monthly)

Calc Method – Fixed amount, Allowance

Payment summary – Allowance A, other

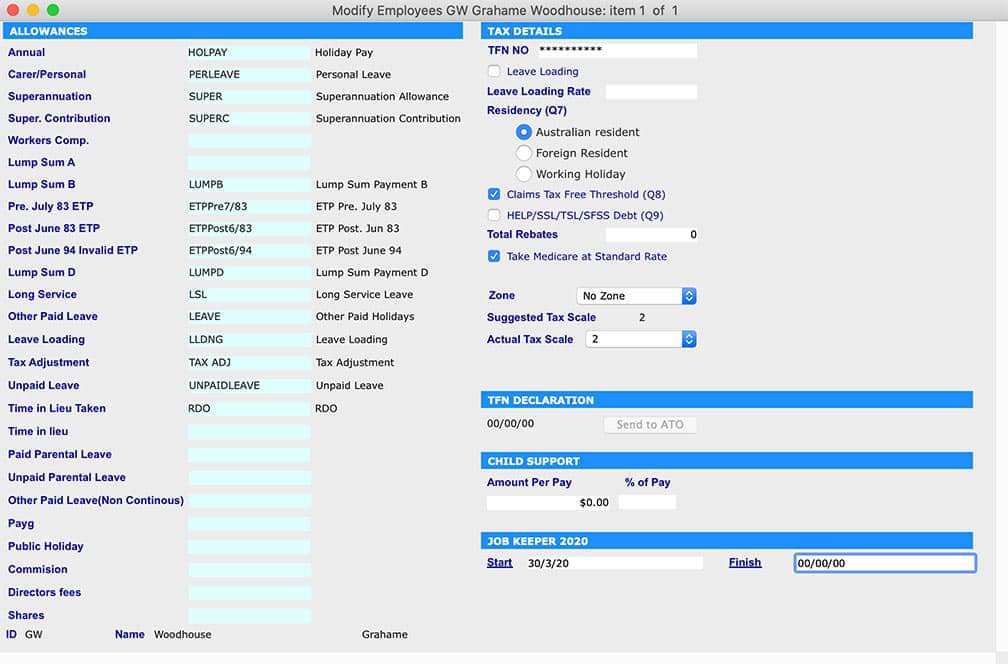

Step 2: Create start date for Job Keeper and leave finish date as 00/00/00

Go to: Payroll >Administration > Employee > Select Employee > Details – Controls > Job Keeper 2020

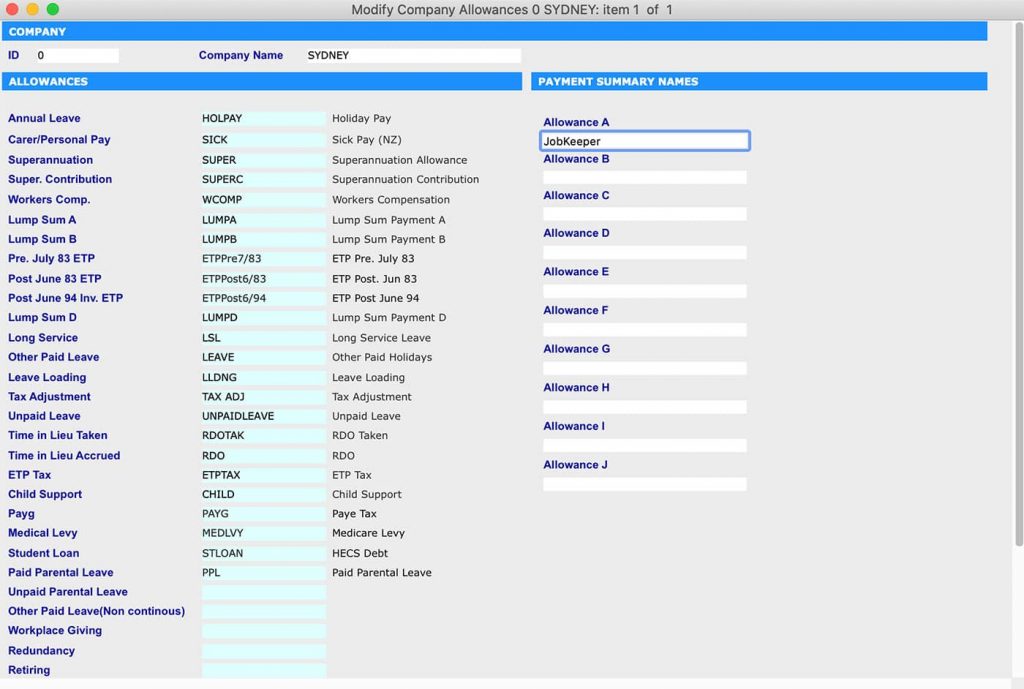

Step 3: Add JobKeeper name in Payment Summary

Go to: Utilities > control > Company > Modify Company > Details -Allowance > add JobKeeper in appropriate Allowance field.

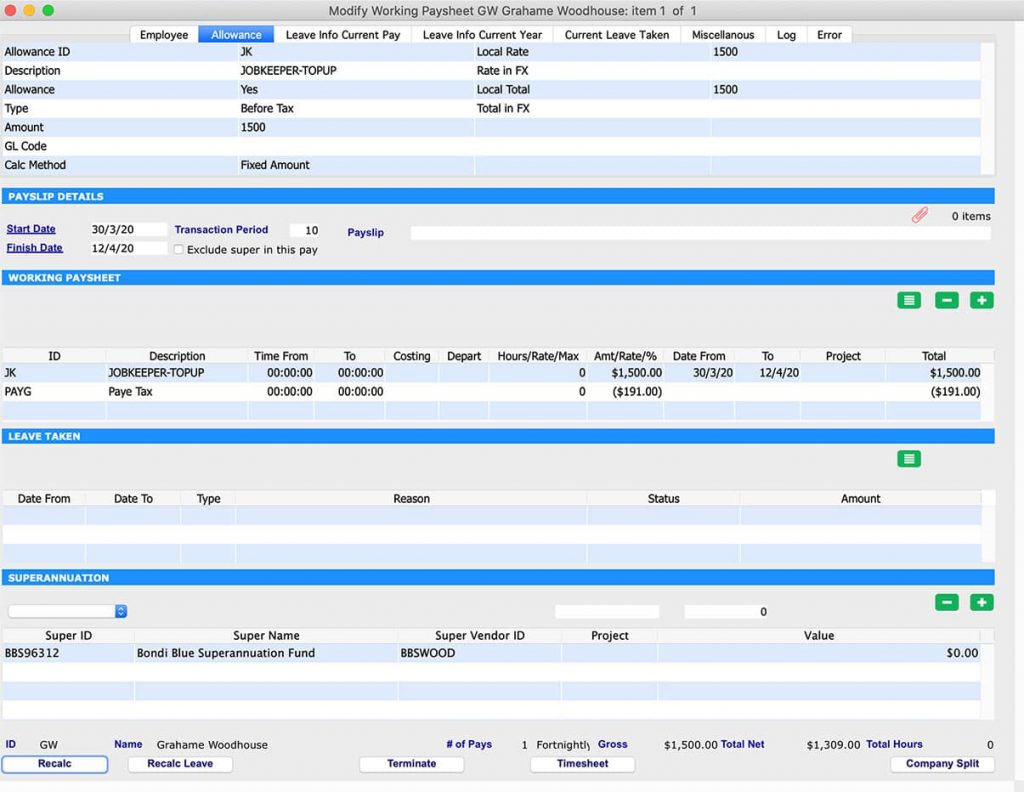

Step 4:Only apply the JobKeeper Wage Payment Item to your Employees who earned $1500 or less or who have been stood down

Go to: Payroll > Payroll > Working Transaction > Select Employee > Add JobKeeper in ‘Working Paysheet’ then click recalc button

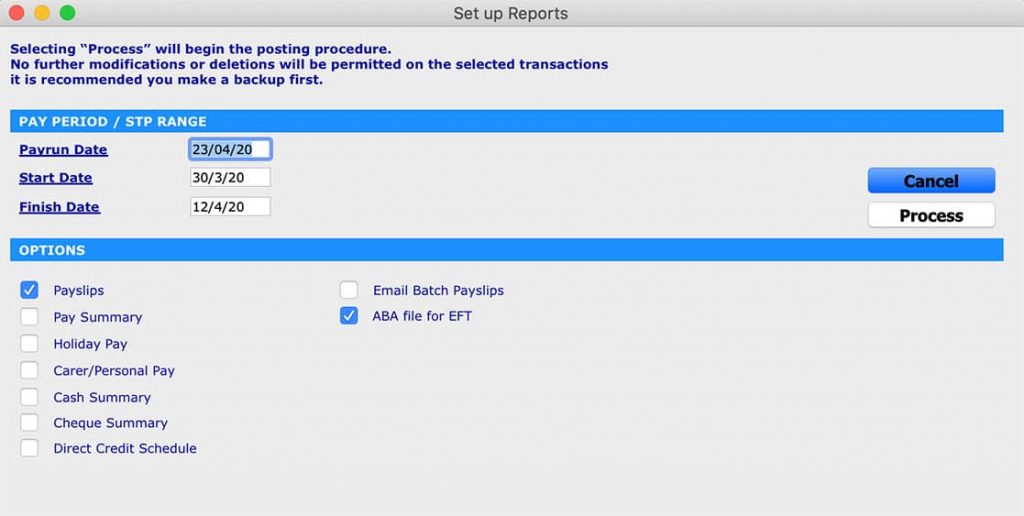

Step 5: Run Payrun to pay employees

Go to: Payroll > Payroll > Pay Run > Select Employee > Process

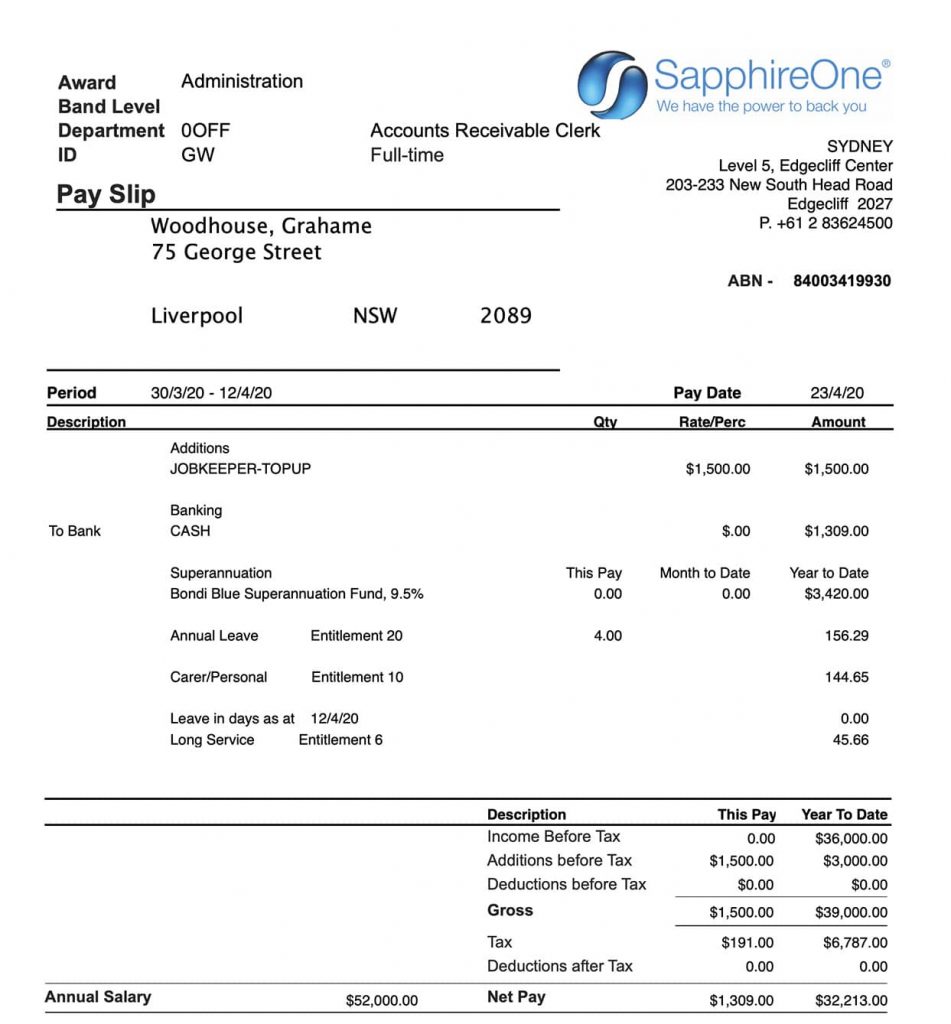

Once the payment is made you can review the payslip. You will notice that this payment has been taxed and Superannuation has been added.

After completion of the payment process, you can submit your STP with the ATO using SapphireOne Single Touch Payroll.

Fringe Benefits and Super with Single Touch Payroll (STP)

July 12, 2019 12:25 pm | by John Adams

All Not For Profit organisations reporting through Single Touch Payroll (STP), can choose how they would like to report fringe benefits amount (RFBA) and employer super contributions (RESC). These fringe benefits are reportable if the total taxable value exceeds the threshold set by the ATO.

There are two options available through STP:

OPTION 1– If you choose to provide your employee’s RFBA and RESC amounts at each payroll or update event, you’ll need to include the amount for each pay run event and amounts for each subsequent payroll event, even if the amounts remain the same.

If you choose to provide your employee’s RFBA and RESC amounts at each payroll or update event, you’ll need to include the amount for each pay run event and amounts for each subsequent payroll event, even if the amounts remain the same.

OPTION 2- You can choose to provide RFBA and RESC amounts through an update event as part of the finalisation process at the end of the financial year.

Payment summaries

If you have chosen not to provide RFBA and RESC amounts through STP, you’ll need to:

- provide employees with this information on a payment summary

- submit a Payment summary annual report to ATO.

How to report fringe benefits and super with STP

If you use Single Touch Payroll (STP), your end-of-year reporting may be different for recording your employee’s:

- reportable fringe benefits amount (RFBA)

- reportable employer super contributions (RESC).

Where year-to-date RFBA and RESC are provided through a payroll or update event during the year, you’ll need to report these amounts for each following payroll event, even if the amounts remain the same.

Alternatively, you may report these amounts through an update event as part of the finalisation process at the end of the financial year.

Guides from the ATO

- FBT – a guide for employers: Chapter 5 – Reportable fringe benefits

- Reportable fringe benefits – facts for employees

- Calculating your FBT

- Reportable employer super contributions – for employers

Australian Taxation Office- Single Touch Payroll (STP) and how it affects business

January 30, 2019 1:20 pm | by John Adams

There has been a lot of talk and sometimes panic about single touch payroll, but many companies can simply update their existing software or choose a product by 1 July 2019. Single Touch Payroll is the next step in streamlining your payroll reporting with the Australian Taxation Office.

SapphireOne was the was first to achieve world-wide full accreditation on 1 May 2018 and our clients have been enjoying the benefits ever since.

STP requires businesses to report directly to the Australian Taxation Office after every pay run with wages, salaries, PAYG and super. STP is mandatory for employers with 20 or more employees from 1 July 2018 and from 1 July 2019 for employers with 19 or less employees.

Businesses will need to report to the Australian Taxation Office after every pay run instead of once a year. No more annual payment summary reports or employee payment summary reports as these are produced by the Australian Taxation Office. Employees simply log into myGov to view their information.

Australian Taxation Office – STP Integration into SapphireOne in a Few Easy Steps

Step 1-

Set-up your Auskey in SapphireOne

If you can’t find your Auskey, contact one of our support team and they will help you

If you have your Auskey:

Go to Utilies Mode, in the Top Menu Bar select Controls then Company

Click on the company in “Company Inquiry” Screen

Under Utilities Mode go to More Details

In SBR box on the bottom right type Auskey in “Keystore File”

Type Auskey password in “KeyStore Password”

Enter in the contact details and then press the upload button

Now you’re ready to run Single Touch Payroll.

Step 2-

In Payroll Mode

In the top tool bar select History then Pay Run Log/STP

Highlight the Pay Run you would like to submit to the ATO

Click on the bottom “STP Submit” button

Navigate back to the “Pay Run Log/STP” screen

Highlight the Pay Run you would like to process

Click on the “STP Get Result” button on the bottom left

You will receive a pop up “Alert” when the report has successfully submitted.

It’s that easy- SapphireOne has Single Touch Payroll and Accounting needs at your fingertips.

For more information regarding improvements and features within the latest release of SapphireOne Business Accounting Payroll Software please contact our office on (02) 8362 4500 or request a demo.

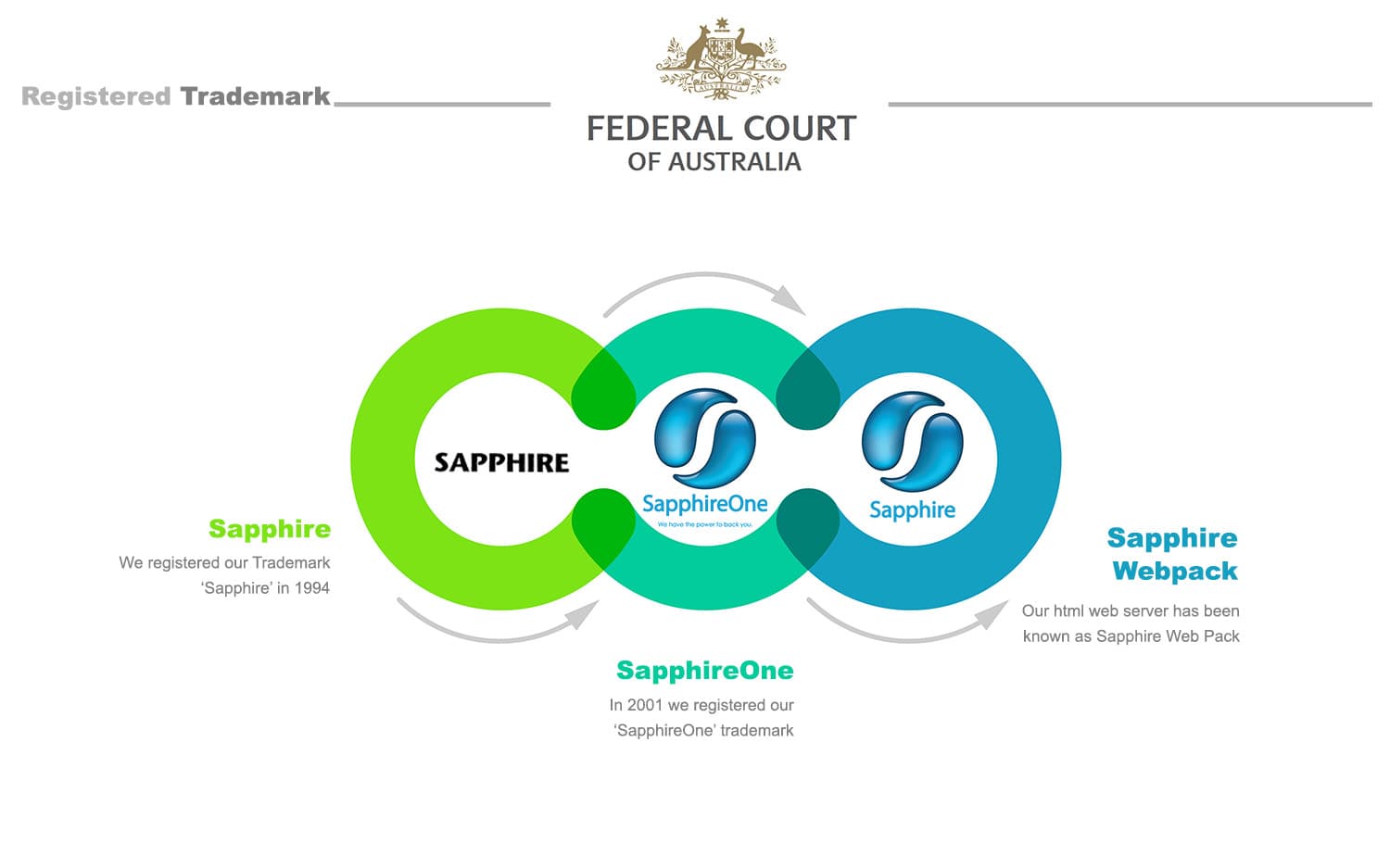

Justice Bromwich in the Federal Court of Australia made orders restraining Sapphire Systems Pty Ltd from infringement of our Sapphire Trade Mark

June 19, 2018 5:09 pm | by John Adams

In May 2017, Justice Bromwich in the Federal Court of Australia made orders restraining Sapphire Systems Pty Ltd from infringement of our Sapphire Trade Mark (a copy of the orders can be viewed at this link).

An order was subsequently made that Sapphire Systems was required to pay us $20,000 and also pay our legal costs incurred in the proceedings.

Our company SapphireOne Pty Ltd was delighted to have its concerns of unauthorised infringement of its intellectual property rights vindicated in such a fulsome way.

We were represented by the following legal team:

Bart Adams of Adams & Co Lawyers

Barrister Andrew Fox

www.5wentworth.com/junior-counsel/andrew-fox

Barrister Anna Spies

SapphireOne is an Australian company distributing globally providing an all-inclusive software application for managing Enterprise Resource Planning (ERP), Contact Relationship Management (CRM) and Document Management System (DMS). These offerings consist of a standalone Single User application named Sapphire, our Client Server application named SapphireOne and our Sapphire Web Pack solution. With our clients established globally, SapphireOne has been providing business freedom since 1986.

We registered our Trademark ‘Sapphire’ in 1994, this was our first Trademark registration initially registering it in Australia.

In 2001 we registered our ‘SapphireOne’ trademark. The additional name was brought about by the merger of the Sapphire Financials, Sapphire Assets, Sapphire Point of Sale (POS) and Sapphire Payroll Human Resources (HR) into a single application, hence we added the ‘One’ to signify the unification of all four applications into one.

From this point onwards our Single User standalone application has been known as Sapphire, our client server application has been known as SapphireOne, our html web server has been known as Sapphire Web Pack.

For a sneak peek at the full capabilities ERP, CRM, Accounting Software, Human Resources, Payroll, Assets and Document Management, check out SapphireOne and request a live demo, it is everything you’ll ever need to make your company management a success. Know more about us

Accelerate your Warehousing, Distribution and Logistics Business Enterprise with SapphireOne ERP

June 8, 2018 3:55 pm | by John Adams

Warehousing, distribution and logistics businesses have a critical need to manage their inventory in a timely and efficient manner. When shipping direct to retailers or customers your ERP solution becomes mission critical for the smooth ongoing operation of your business enterprise.

SapphireOne will meet all your warehousing, distribution and logistics requirements with integrated EDI/API functionality. Our large range of API vendors include freight forwarders, courier companies and various third-party transport and distribution operators. The SapphireOne ERP has everything inbuilt that a warehousing, distribution and logistics business needs, and can help you to create the highest level of efficiency at the lowest cost of operation for your warehousing, distribution and logistics business enterprise.

Some examples of the built-in functionality include unlimited barcodes per item, unlimited images per item, bill of materials with unlimited levels, serial batch control, multiple costing types, material resource processing (MRP), material safety datasheets (MSDS) bin/bay management, multi-location, multi-warehouse, SSCC labling.

SapphireOne ERP is perfect for SMEs and large companies for the wholesale Warehousing, Distribution and Logistics business enterprises

SapphireOne ERP is suitable for large companies, as well as small and medium-sized enterprises (SMEs) providing extremely high quality information in real time covering all your inventory requirements.

Wholesale distribution and logistics is an extremely competitive market place, it is critical that when dealing with all your inventory needs it is handled in real time.

SapphireOne’s inventory management functionality tracks stock movements quantifying the volume while simultaneously tracking bin and bay management of all inventory items throughout the warehouse.

SapphireOne ERP is an integrated Accounting, Payroll/HR and Inventory Management software solution

At SapphireOne we understand that a wholesale, distribution and logistics business needs to have integration between financials, warehousing, and a full range of customer and supplier information to help anticipate future needs.

SapphireOne ERP system offers an integrated accounting, payroll/HR, inventory management software solution that is perfect to increase efficiency in your warehousing, distribution and logistics business enterprises.

SapphireOne allows you to analyse Payroll/HR expenses and employee productivity to help control costs and review expense distribution.

SapphireOne can facilitate the design of an efficient warehouse, distribution and logistics system to create the foundation of an efficient supply chain, one that can service your customers in real time.

For the full capabilities of the ERP, CRM, Accounting Software, Human Resources, Payroll, Assets and Document Management, check out the SapphireOne website and request a live demo.

SapphireOne – We have the Power to back you. Find Out More Details