Increasing Workflow Efficiencies of Managing Payments

May 18, 2020 4:31 pm | by John Adams

The manual payment method in Accounts Payable processing is a time-intensive process for your Accounts department. In addition, any manual operation creates the possibility of human error which can result in inconvenient effects on the production flow and costs. Although a manual Accounts Payable workflow is scalable to a certain extent, it will become inefficient and unviable in cases where a large volume of invoices needs to be processed on a daily basis.

Electronic payments are digital transfers of payments from your Enterprise Resource Planning (ERP) or Accounts Payable system to the supplier’s designated bank account via a Bank’s payment portal. Any electronic payment significantly reduces the burden of managing payments manually. Although the creation of an electronic Accounts Payable process is a challenging task, setting up an automated workflow for Accounts Payable leads to substantial efficiencies for your company.

EFT Processing for Accounts Payable

Electronic Fund Transfers (EFT) are commonly used for deposits of Accounts Payable. They constitute a safe and convenient option of processing payments. As a result, EFTs have become the predominant method of transferring funds for both businesses as well as consumers.

Facilitating the Accounts Payable function by using EFTs offers numerous benefits, including the below:

- Reducing Workload and Scope for Error and Fraud

- Optimizing Cash Flows

- Improving Buyer-Supplier Communications

Instead of manually handling all incoming invoices, all data is entered into the Accounts Payable system and payments are made via EFTs which are processed by the bank. Cheques, in comparison, may be lost, misplaced or obtained fraudulently and also require a significant amount of paperwork that consumes valuable storage space. Your Accounts Payable team will also be able to focus its time on more value-adding tasks.

An electronic exchange of purchase invoices not only allows for faster processing, but also enables improved tracking of all expenditures, as the software records any transaction being made. The traceability derived helps to improve the management of the cash flow, increases the precision of financial statements and it also allows for easier auditing.

Electronic invoices increase the transparency of their processing for both the supplier and the buyer, which aids in avoiding, as well as in resolving disputes between the parties.

Enhancing Accounts Payable Processing Time with SapphireOne

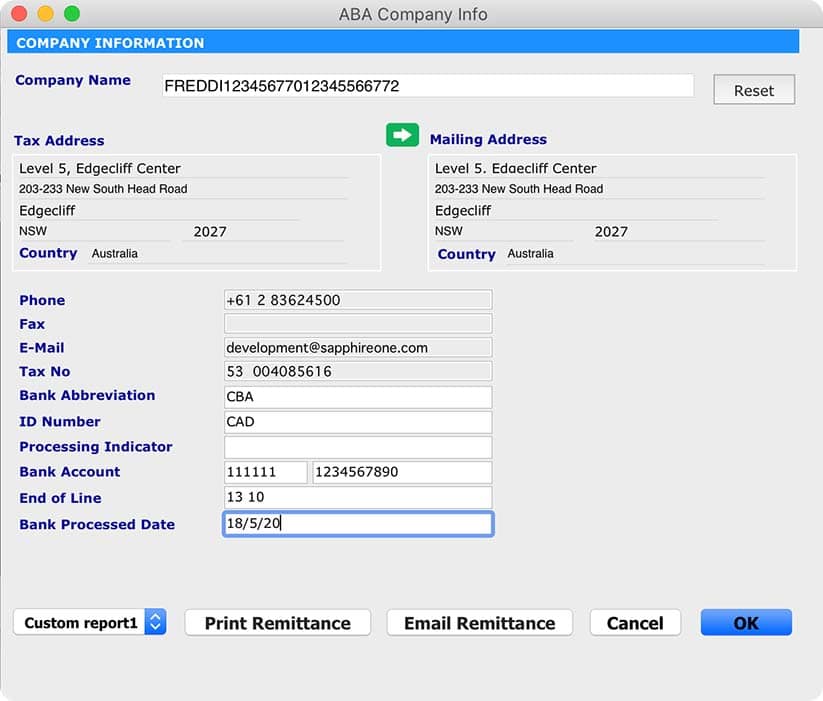

SapphireOne offers the ability for electronic payments by preparing an electronic payment file to be processed by the buyer’s bank. These files are prepared in accordance with the format prescribed by the Australian Bankers’ Association (ABA file) and all major Australian financial institutions use them to record payments to be made from one bank account to one or multiple others. The information contained within an ABA file includes the payer’s and payee’s bank details and the amount to be paid, with any file being able to hold information on multiple payments as well.

Before you can prepare an electronic payment file in SapphireOne, you will need to complete the electronic payment set-up tasks. Once you have recorded all payments to suppliers you want to pay electronically, you can prepare an ABA file. Once created, you can upload it to your bank for processing of the payment.

Setting Up Vendors for Electronic Payments

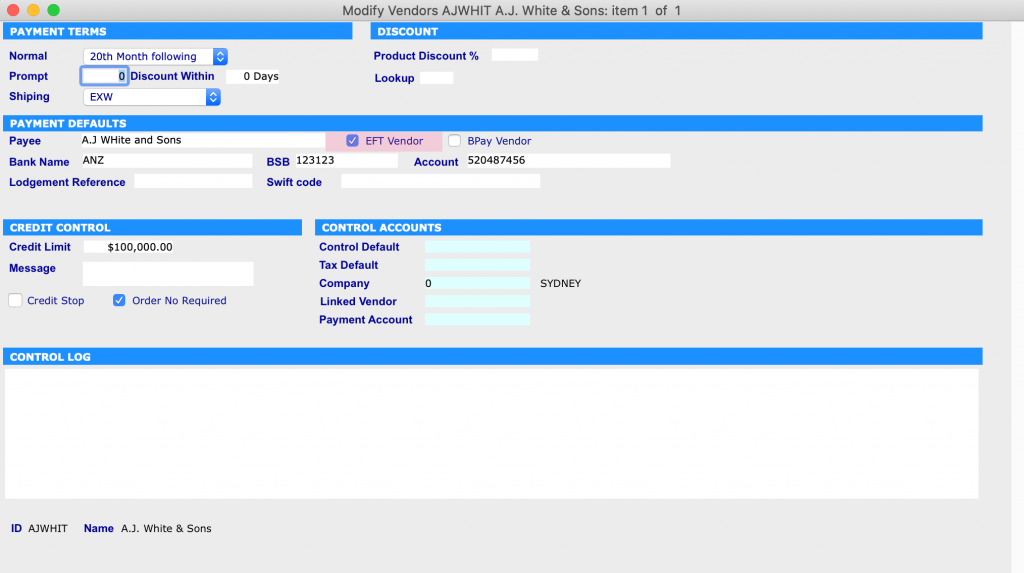

Go to: Accounts > Payables > Vendor Inquiry > Vendor Terms Page > Select: EFT checkbox and Provide: Account details

Creating Payment

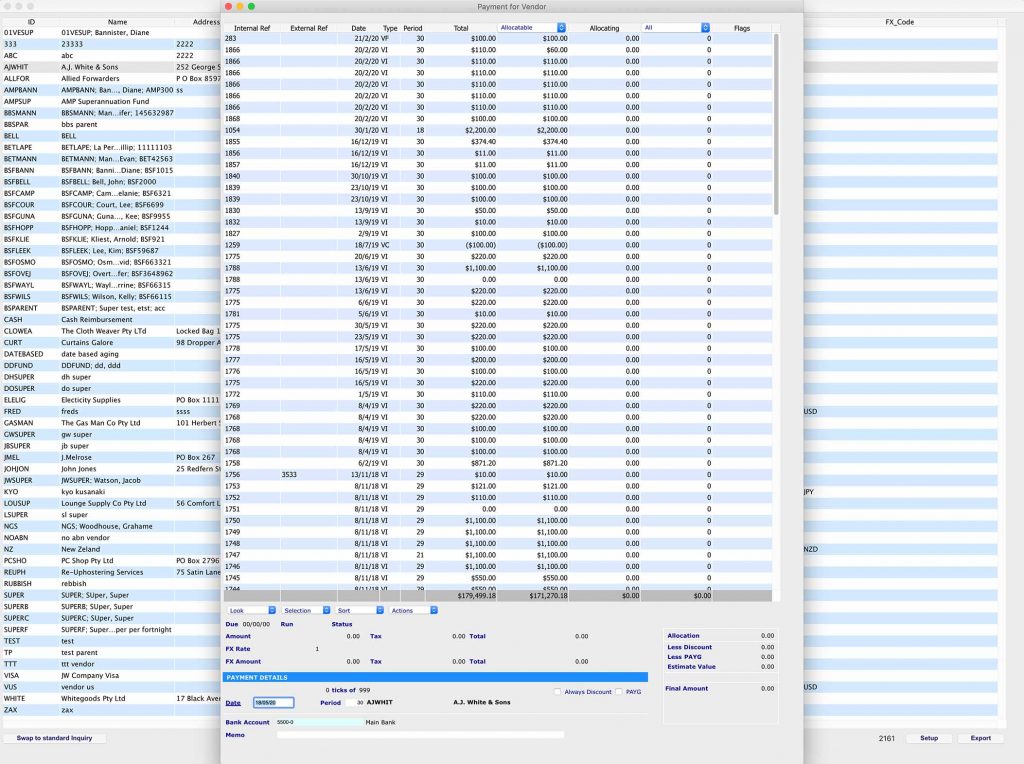

Go to: Accounts > Payables > Payments > Create: Payments > Select: Vendor and Click: Tool > Create: Payments > Select: Invoice or invoices > Green tick

Generating ABA file

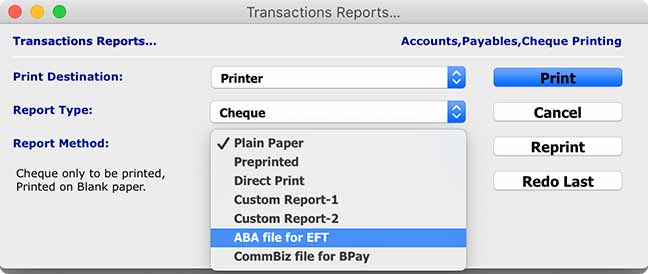

Go to: Accounts > Payables > Payments > Print: Payments > Select: Bank > Print: Dialogue is displayed > Select: Your Report Type and Method (In this case it is ‘Remittance’ and ‘ABA File for EFT’) > Print > Select: Vendor for generating ABA file > Save: ABA file

ABA files allow you to pay any invoices through your internet banking provider. However, each provider has a different set of instructions on how to process ABA payments, which you will need to follow in order to complete any transactions.

Please book a support call via our website, in case you have any questions or need any further assistance.

The future of Enterprise Resource Planning – ERP

February 23, 2018 3:30 pm | by John Adams

Technological changes are growing at a rapid pace and the minute we buy a new software there comes a more sophisticated one. It’s a challenging situation both for the employees and employers and the companies are realising the importance of staying updated with the latest trends.

Enterprise Resource Planning helps the companies to make effective and real-time decisions thereby strengthening the organisation’s profit. There are many factors that can influence the future of ERP. A leader in providing Accounting Software, Payroll Software, CRM Software, ERP software.

SapphireOne believes that the following factors will play an important role in the future of ERP.

User-friendly Enterprise Resource Planning System

Employees are looking for a more user-friendly Enterprise Resource Planning system that will solve their practical problems. Companies are developing Enterprise Resource Planning software with superior architecture and slick designs. The demand for a pro-active and next-gen Enterprise Resource Planning system is never-ending. This puts a lot of pressure on the ERP suppliers to give the customer the swiftest and most attractive Enterprise Resource Planning software. Today’s workers are better equipped to face the technological changes and they should be supplied with the best Enterprise Resource Planning.

Mid-market ERP

It’s the era of ‘Smart’ products and today’s employees want to use their Enterprise Resource Planning technology anytime, anywhere. Nowadays companies are opting for accessories that they can use on the go, like opting for mobiles over desktops. Mid-market ERP solution gives you uninterrupted access to your data and in turn influences the decision makers. For Example, business people need an Accounting software that helps them save time by making invoices on the move.

Customisation

Mid-size organisations are in need of a customised ERP software that will easily help them in managing operations, sales, accounts, inventory etc. The mid-size companies are looking for a cost-effective Enterprise Resource Planning that is user-friendly and that will help them to compete with the bigger organisations. For example, many businesses need a Document Management System to maintain their records easily and keep them updated.

A challenge for the suppliers is to come up with a flawless Enterprise Resource Planning software that can be easily integrated and easily implemented. SapphireOne provides the clients with most savvy and smooth ERP, CRM & Business Accounting Software. Seize the benefits of SapphireOne ERP software.

Managing time and attendance sheet with SapphireOne ERP Accounting System

October 23, 2017 10:52 am | by John Adams

Time & attendance system is a very useful management tool being used by businesses or organisations to improve payroll efficiency, reduce time theft, run administrative functions efficiently and provide accurate labour costing. It comes as a stand-alone software, but SapphireOne ERP Accounting Software is a fully-integrated ERP Accounting Software solution that includes a time & attendance software module covering all aspects of time & attendance sheet to accurately and easily run your business’s payroll and HR and administration operations. This will maintain an accurate employee timesheet, automatically calculate hours worked by employees, and perform more tasks efficiently and instantly.

SapphireOne is the complete business, ERP, CRM, and accounting software package. There is no additional bolt on modules, so you get all functionality, from ERP, accounting software to time & attendance system, and more. Time & attendance section allows you to track or capture the latest time and attendance recordings of your employees. With SapphireOne, you can track your employees’ attendance records easily and maintain an accurate staff scheduling system.

Manage your business’s time & attendance sheet

The time & attendance system is a section included in Sapphire single user and SapphireOne Client Server ERP Accounting Software and it is suitable for all business looking to:

- Maintain an accurate staff scheduling system

- Accurately and easily track all your labour costs any time and attendance trends

- Eliminates delays in the payroll/HR process

- Eliminate the need for manual processes, or multiple spreadsheets and systems that are time-consuming and do not communicate with each other well

- View employees’ daily or complete history of attendance including hours worked, breaks, start and finish times, absenteeism, leave and more

- Generate any employee’s attendance report instantly, making it easier for payroll and HR functions to process payroll accurately and quickly

- Customise time & attendance sheet of an employee, or employees working together on a specific project working in-house or remotely from office.

- Spend less time and resources on manual paperwork

SapphireOne ERP CRM and Accounting Software makes it easy to manage your business’s time & attendance sheet which can be access real time using Sapphire Web Pack which can be accessed using any device that can run a browser. It provides daily time & attendance sheet to track who worked when, where and for how long, and identify employees that did not work or were late at work, and additional information. It gives you full details of the daily employee worked hours, provides details of missing employees and who did not clock / login in or out. This enables you, your HR and administration department(s), or your employees to record actual time worked on specific projects, departments or jobs using timesheets by resource and activity.

Integrated time and attendance system inside ERP Accounting Software increases your workplace’s efficiency and accuracy, eliminating manually managed staff/employee record book/attendance register book and duplicate data entry. It also enables you or/and your employees to update personal data of employees, enter holiday leave as well as outstanding, accrued and advanced leave requests for employees, giving peace of mind knowing that employee payroll will be accurate.

Whether you have a small or medium-sized business, SapphireOne ERP and Accounting Software will always help you manage the accurate time & attendance sheet of your company’s employees effectively. This powerful, flexible and easy-to-use system will save your business time and money, increase employees’ productivity and give you instant information on your business. You can calculate hours worked, overtime, pre-planned future personal leave, breaks, hours to pay, and more to can take your business to the next level.

For a sneak peek at the full capabilities of an account payable system check out Sapphireone and request for a live demo, its everything you’d ever need to make your accounting system a breeze.

A flexible and scalable mid-market ERP Solution

October 3, 2017 1:27 pm | by John Adams

Now a days the mid-market is filled with innovative and vertical-focused ERP solutions. What does Mid-Market ERP refer to? The answer is complex but The choice of selecting Enterprise Resource Planning (ERP) software is a make-or-break decision and it involves lots of research and study of company’s ERP requirements. ERP software always need some customisation to fit a particular business. Mid-size companies usually look for fast return on investment when choosing an ERP software. This is one of the many reasons why they prefer flexibility and scalability in an ERP solution for growing their business.

ERP comes in modules which includes many functions such as General Ledger, Payroll, Accounts Payable, Accounts receivable, Invoicing, Budgeting, Cash management, Taxation reporting, Asset management and purchasing, Project accounting, Job costing, Flexible Ad Hoc Reporting/ Quick Reports, Multi entity/company and multi-currency accounting functionality. According to research, the Mid-market is filled with vertical-focused ERP solutions. These enterprises predominately are seeking to select an ERP system for financial management and efficient operational planning. Some other ERP use cases are geographic expansion and controlling all business resources as quickly as possible.

SapphireOne is a very versatile product and caters to many business types. SapphireOne provides ongoing user and technical support for smooth running of the business. By subscribing to SapphireOne’s Diamond Support plan companies can benefit with unlimited email & phone support and can receive the latest version updates, which are available to download from SapphireOne SFTP server.

SapphireOne meets the criteria and weighting factors that is needed to cover the whole of the mid-market erp space :-

- Features: SapphireOne has simple and advance functionality to meet organisation’s regulatory complexity. SapphireOne’s software suite is simple & smart, full-featured easy to use solution ideally designed for medium or large business enterprise. You can start Sapphire single user progressing to SapphireOne for your small to medium sized business for accounting or ERP needs. SapphireOne has the capability to grow with your business.

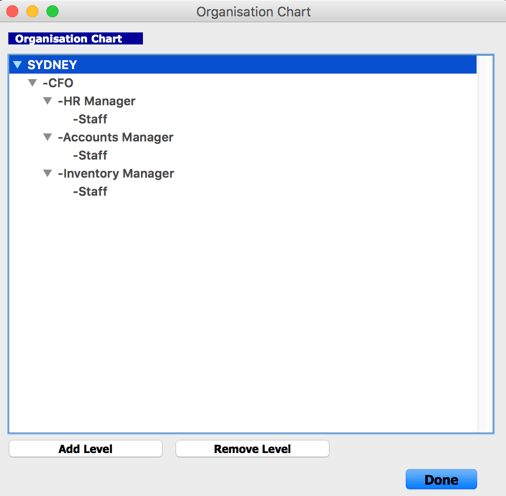

- Usability: SapphireOne has an option for the setting up of workflow levels, allowing for control of the processing of transactions within the system

- Affordability: We understand that customers expect a Holistic pricing strategy. We provide a complete list of the pricing structure during our demonstration phase. That’s why our customers find Implementing and operating the SapphireOne solution affordable without any hidden costs.

- Architecture: SapphireOne has multi-company management capabilities, designed to improve the performance of enterprise business by mitigating the accounting challenges. It is an on-premises software which also has an integrated web-based solution called Sapphire Web Pack.

Request a demo today, the purchase of accounting software or ERP Software is an important investment, don’t leave it to chance.

SBR2 Requirements in Australia for Accounting Software

August 25, 2017 2:36 pm | by John Adams

In Australia, over the past year, the Accounting and Enterprise Resource Planning (ERP) software market has seen seismic changes as new players arrive on the scene and the market consolidates. In addition, the Australian Tax Office (ATO) has been updating to a new standard called Standard Business Reporting 2 (SBR2) and switching to a new lodgement system for tax reports. Therefore, the choice of selecting software for all businesses is becoming increasingly important, especially in the minds of those responsible for choosing an accounting software.

If you are in Australia, you have to make sure the Accounting software you buy complies with the new ATO requirements regarding SBR2

New compliance requirement for Accounting Software

The Australian Taxation Office (ATO) has asked vendors of accounting and financial management software to create a gateway to enable direct submission of Standard Business Reporting (SBR). The system will use the same SBR system, only now it will be upgraded to SBR2. The ATO states that this is a further move to automate and streamline the tax system and both businesses and the State Government will benefit from lower costs and time efficiency savings.

The ATO wants software vendors to enable direct SBR lodgement. SBR is a standardised approach to online and digital tax records which was first introduced by the Australian government in 2010. The intention was to simplify business obligations when reporting to the ATO. SBR is currently built into business and accounting software. This next step is to automate delivery direct to the ATO from the software itself and has already been partially implemented by many vendors in Australia.

Streamlining the SBR lodgement process

Currently businesses can lodge reports via the GovReports website, called Electronic Lodgement Service (ELS). The aim of the ATO is to remove this in-between stage and lodge SBR directly from the business software to the ATO. This is called Practitioner Lodgement Service (PLS) and offers significant enhancements over the ELS system. Customers will continue to use the AUSkey security system which enables businesses and individuals a secure connection to a whole variety of Australian government departments.

PLS is a ‘two-way street’ rather than the ‘one-way’ ELS. Entries made into accounting software will be checked in real time with existing ATO records and errors or inconsistencies highlighted so corrections can be made.

The theory is that increasing the quality of submissions like this should reduce the workload of both tax practitioners and the ATO, therefore leading to a quicker service and faster tax return. Many software vendors have already incorporated PLS into their software, with more to follow in a series of updates.

Single Touch Payroll is one of the stand out features of the new SBR system. Under this feature, employers will be able to report salary, Pay As You Go (PAYG) withholding and other information directly to the ATO at the same time as they pay their employees. All of this will be done directly from their payroll software. This will benefit businesses in Australia by making the payroll system clearer, quicker, faster and easier.

SBR2 will combat against cybercrime

2017 has seen a surge in cybercrime worldwide. This is being widely attributed to the theft of material from the US National Security Agency (NSA) last year. Two attacks in particular have rort havoc in Europe with the second, ‘Petya’ emanating from an accounting software firm in the Ukraine. Experts have linked the Petya virus directly with an NSA tool called ‘Eternal Blue’.

A security company CrowdStrike proclaimed that both the Australian government and businesses are under constant attack from cybercriminals. This is in part since the country is allied with the U.S. and the major hacking networks do appear to target ‘the West’. They even came up with comic book style characters representing the key cybercrime players, Fancy Bear, Deep Panda and Charming Kitten, Russia, China and Iran respectively.

It should be noted that CrowdStrike has a vested interest in shouting about this proliferation in cybercrime, holding as it does contracts with both the Australian Government and businesses in the country. The company recently raised US$ 100 million in a round of investment, valuing it at around US$ 1 billion. It is difficult to ignore the evidence that attacks are on the increase and are becoming increasingly sophisticated.

The ATO, software vendors and Australian businesses themselves clearly face an ongoing battle with cybercrime during a difficult transition period. A recent survey reports that 29% of tax practitioners are already using PLS. The new PLS service will be expanded and phased in through a series of deadlines over the remainder of 2017 and into 2018, with ELS phased out by the 1st April 2018. As such, businesses will be obligated to use SBR2 enabled software and need to have confidence both in the vendor and the ATO. This will eventually mitigate the risk in regards to fraud or some cybercrime.

Buyer’s Guide to Accounting Software

Therefore to meet the compliance requirements, businesses should consider a new point in how to choose the best accounting software :

Will your Accounting Software be SBR2 enabled in 2018, so that they can lodge their business activity statement (BAS) and other forms directly to the Australian Taxation Office (ATO)?

SapphireOne News :

SapphireOne is now incorporating the new ATO requirements regarding SBR2. We are expecting to go live with these before the end of 2017.